Exploring Taiwan Semiconductor's Earnings Expectations

Taiwan Semiconductor (NYSE:TSM) is set to give its latest quarterly earnings report on Thursday, 2025-07-17. Here's what investors need to know before the announcement.

Analysts estimate that Taiwan Semiconductor will report an earnings per share (EPS) of $2.37.

Taiwan Semiconductor bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

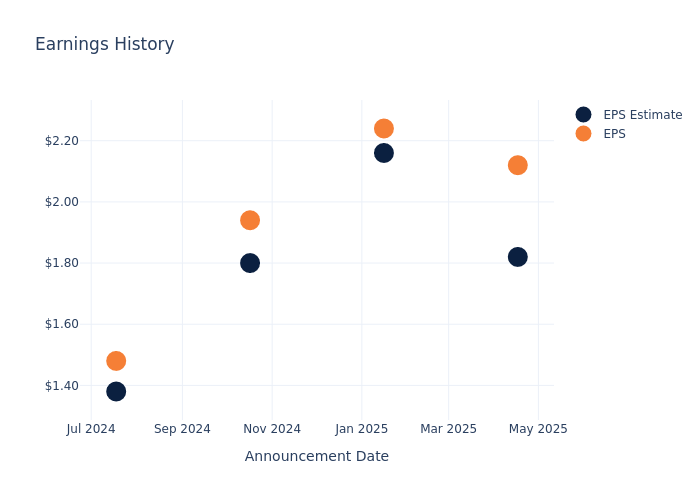

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.30, leading to a 0.0% drop in the share price on the subsequent day.

Here's a look at Taiwan Semiconductor's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.82 | 2.16 | 1.80 | 1.38 |

| EPS Actual | 2.12 | 2.24 | 1.94 | 1.48 |

| Price Change % | 0.0% | -2.0% | -2.0% | -4.0% |

Performance of Taiwan Semiconductor Shares

Shares of Taiwan Semiconductor were trading at $236.95 as of July 15. Over the last 52-week period, shares are up 37.29%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Taiwan Semiconductor

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Taiwan Semiconductor.

Analysts have provided Taiwan Semiconductor with 7 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $245.71, suggesting a potential 3.7% upside.

Analyzing Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Advanced Micro Devices, Texas Instruments and Qualcomm, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Advanced Micro Devices, with an average 1-year price target of $140.19, suggesting a potential 40.84% downside.

- Analysts currently favor an Neutral trajectory for Texas Instruments, with an average 1-year price target of $197.4, suggesting a potential 16.69% downside.

- Analysts currently favor an Neutral trajectory for Qualcomm, with an average 1-year price target of $180.73, suggesting a potential 23.73% downside.

Peers Comparative Analysis Summary

Within the peer analysis summary, vital metrics for Advanced Micro Devices, Texas Instruments and Qualcomm are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Broadcom | Outperform | 20.16% | $10.20B | 7.12% |

| Advanced Micro Devices | Outperform | 35.90% | $3.74B | 1.23% |

| Texas Instruments | Neutral | 11.14% | $2.31B | 7.08% |

| Qualcomm | Neutral | 16.93% | $6.04B | 10.30% |

Key Takeaway:

Taiwan Semiconductor ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

Delving into Taiwan Semiconductor's Background

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with mid-60s market share in 2024. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public in Taiwan in 1994 and as an ADR in the US in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Key Indicators: Taiwan Semiconductor's Financial Health

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Taiwan Semiconductor displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 41.61%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 42.98%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Taiwan Semiconductor's ROE stands out, surpassing industry averages. With an impressive ROE of 8.19%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 5.22%, the company showcases effective utilization of assets.

Debt Management: Taiwan Semiconductor's debt-to-equity ratio is below the industry average at 0.22, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Taiwan Semiconductor visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.