A Look Ahead: Verizon Communications's Earnings Forecast

Verizon Communications (NYSE:VZ) is preparing to release its quarterly earnings on Monday, 2025-07-21. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Verizon Communications to report an earnings per share (EPS) of $1.19.

Anticipation surrounds Verizon Communications's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

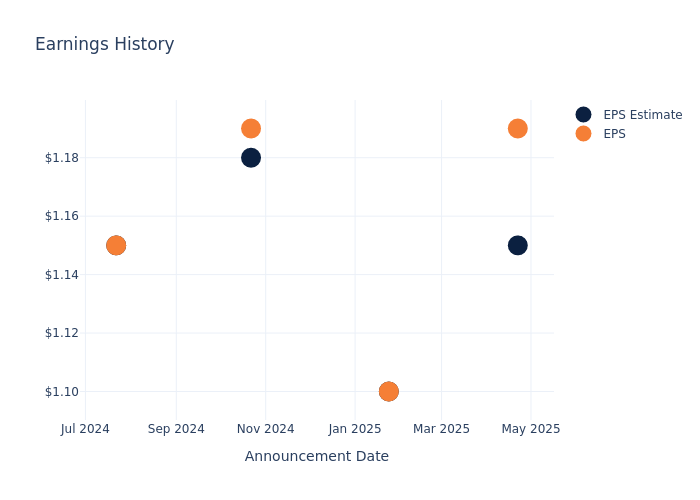

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.04, leading to a 1.13% drop in the share price the following trading session.

Here's a look at Verizon Communications's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.15 | 1.1 | 1.18 | 1.15 |

| EPS Actual | 1.19 | 1.1 | 1.19 | 1.15 |

| Price Change % | -1.0% | 1.0% | 3.0% | -1.0% |

Stock Performance

Shares of Verizon Communications were trading at $40.95 as of July 17. Over the last 52-week period, shares are up 4.9%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Verizon Communications

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Verizon Communications.

With 5 analyst ratings, Verizon Communications has a consensus rating of Neutral. The average one-year price target is $48.0, indicating a potential 17.22% upside.

Analyzing Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of AT&T and Shenandoah, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for AT&T, with an average 1-year price target of $30.61, suggesting a potential 25.25% downside.

- Analysts currently favor an Buy trajectory for Shenandoah, with an average 1-year price target of $26.0, suggesting a potential 36.51% downside.

Peers Comparative Analysis Summary

The peer analysis summary outlines pivotal metrics for AT&T and Shenandoah, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Verizon Communications | Neutral | 1.53% | $20.43B | 4.88% |

| AT&T | Outperform | 1.99% | $18.59B | 4.22% |

| Shenandoah | Buy | 26.93% | $54.87M | -1.16% |

Key Takeaway:

Verizon Communications ranks first in gross profit and return on equity among its peers. It ranks second in revenue growth.

Discovering Verizon Communications: A Closer Look

Wireless services account for nearly 75% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 20 million prepaid phone customers via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 30 million homes and businesses, including about 20 million with the Fios fiber optic network. These networks serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks. Verizon agreed to acquire Frontier Communications in September 2024.

Verizon Communications's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Verizon Communications's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 1.53%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: Verizon Communications's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.57%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Verizon Communications's ROE stands out, surpassing industry averages. With an impressive ROE of 4.88%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Verizon Communications's ROA excels beyond industry benchmarks, reaching 1.28%. This signifies efficient management of assets and strong financial health.

Debt Management: Verizon Communications's debt-to-equity ratio surpasses industry norms, standing at 1.67. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Verizon Communications visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.