Earnings Outlook For Agilysys

Agilysys (NASDAQ:AGYS) will release its quarterly earnings report on Monday, 2025-07-21. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Agilysys to report an earnings per share (EPS) of $0.32.

The announcement from Agilysys is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

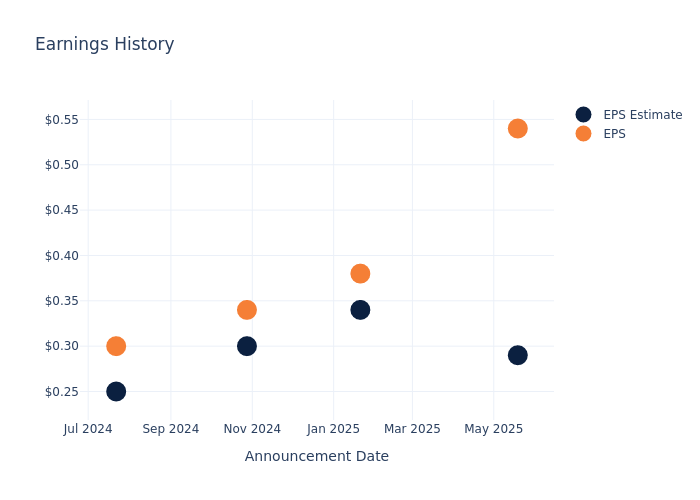

Historical Earnings Performance

Last quarter the company beat EPS by $0.25, which was followed by a 22.1% increase in the share price the next day.

Here's a look at Agilysys's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.29 | 0.34 | 0.30 | 0.25 |

| EPS Actual | 0.54 | 0.38 | 0.34 | 0.30 |

| Price Change % | 22.0% | -20.0% | -8.0% | -5.0% |

Stock Performance

Shares of Agilysys were trading at $119.39 as of July 17. Over the last 52-week period, shares are up 4.94%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Perspectives on Agilysys

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Agilysys.

Agilysys has received a total of 2 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $115.0, the consensus suggests a potential 3.68% downside.

Analyzing Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Asana, Intapp and BlackLine, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Asana, with an average 1-year price target of $16.38, suggesting a potential 86.28% downside.

- Analysts currently favor an Buy trajectory for Intapp, with an average 1-year price target of $61.43, suggesting a potential 48.55% downside.

- Analysts currently favor an Neutral trajectory for BlackLine, with an average 1-year price target of $53.2, suggesting a potential 55.44% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Asana, Intapp and BlackLine, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Agilysys | Buy | 19.37% | $45.05M | 1.50% |

| Asana | Neutral | 8.59% | $168.04M | -17.26% |

| Intapp | Buy | 16.66% | $96.41M | -0.61% |

| BlackLine | Neutral | 6.01% | $126.01M | 1.40% |

Key Takeaway:

Agilysys ranks at the top for Revenue Growth among its peers. It is at the bottom for Gross Profit and Return on Equity.

About Agilysys

Agilysys Inc provides hospitality software delivering cloud-native SaaS and on-premise solutions for hotels, resorts, cruise lines, casinos, corporate foodservice management, restaurants, universities, stadiums, and healthcare facilities. The company's software solutions include point-of-sale (POS), property management (PMS), inventory and procurement, payments, and related applications that manage and enhance the entire guest journey. It derives maximum revenue from the provision of software subscription and maintenance services, followed by the provision of professional services, and the sale of products (proprietary software licenses, third-party hardware, and operating systems). Agilysys operates across North America, Europe, the Middle East, Asia-Pacific, and India.

Agilysys: Delving into Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Agilysys's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 19.37%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Agilysys's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 5.28%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Agilysys's ROE excels beyond industry benchmarks, reaching 1.5%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Agilysys's ROA stands out, surpassing industry averages. With an impressive ROA of 0.89%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.18, Agilysys adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Agilysys visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.