An Overview of Lockheed Martin's Earnings

Lockheed Martin (NYSE:LMT) will release its quarterly earnings report on Tuesday, 2025-07-22. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Lockheed Martin to report an earnings per share (EPS) of $6.54.

The announcement from Lockheed Martin is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

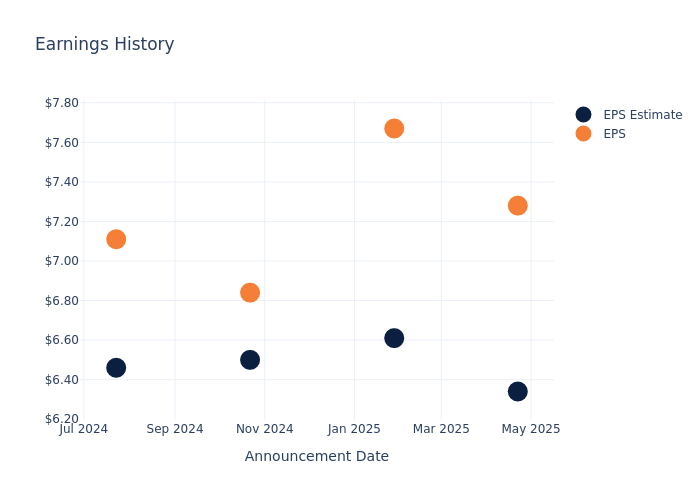

Past Earnings Performance

In the previous earnings release, the company beat EPS by $0.94, leading to a 0.32% increase in the share price the following trading session.

Here's a look at Lockheed Martin's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 6.34 | 6.61 | 6.50 | 6.46 |

| EPS Actual | 7.28 | 7.67 | 6.84 | 7.11 |

| Price Change % | 0.0% | -1.0% | -1.0% | 3.0% |

Market Performance of Lockheed Martin's Stock

Shares of Lockheed Martin were trading at $463.96 as of July 18. Over the last 52-week period, shares are down 7.63%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analysts' Take on Lockheed Martin

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Lockheed Martin.

The consensus rating for Lockheed Martin is Neutral, based on 4 analyst ratings. With an average one-year price target of $518.25, there's a potential 11.7% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of General Dynamics, Howmet Aerospace and Northrop Grumman, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for General Dynamics, with an average 1-year price target of $309.83, suggesting a potential 33.22% downside.

- Analysts currently favor an Outperform trajectory for Howmet Aerospace, with an average 1-year price target of $179.75, suggesting a potential 61.26% downside.

- Analysts currently favor an Outperform trajectory for Northrop Grumman, with an average 1-year price target of $546.33, suggesting a potential 17.75% upside.

Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for General Dynamics, Howmet Aerospace and Northrop Grumman, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lockheed Martin | Neutral | 4.47% | $2.32B | 26.31% |

| General Dynamics | Buy | 13.90% | $1.89B | 4.49% |

| Howmet Aerospace | Outperform | 6.47% | $583M | 7.43% |

| Northrop Grumman | Outperform | -6.56% | $1.58B | 3.18% |

Key Takeaway:

Lockheed Martin ranks first in revenue growth among its peers. It leads in gross profit and return on equity as well.

Get to Know Lockheed Martin Better

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Aeronautics is Lockheed's largest segment, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

Financial Insights: Lockheed Martin

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Lockheed Martin's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 4.47%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Lockheed Martin's net margin excels beyond industry benchmarks, reaching 9.53%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Lockheed Martin's ROE excels beyond industry benchmarks, reaching 26.31%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Lockheed Martin's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.05%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.04, caution is advised due to increased financial risk.

To track all earnings releases for Lockheed Martin visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.