What's Next: Karooooo's Earnings Preview

Karooooo (NASDAQ:KARO) will release its quarterly earnings report on Tuesday, 2025-07-22. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Karooooo to report an earnings per share (EPS) of $0.45.

Investors in Karooooo are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

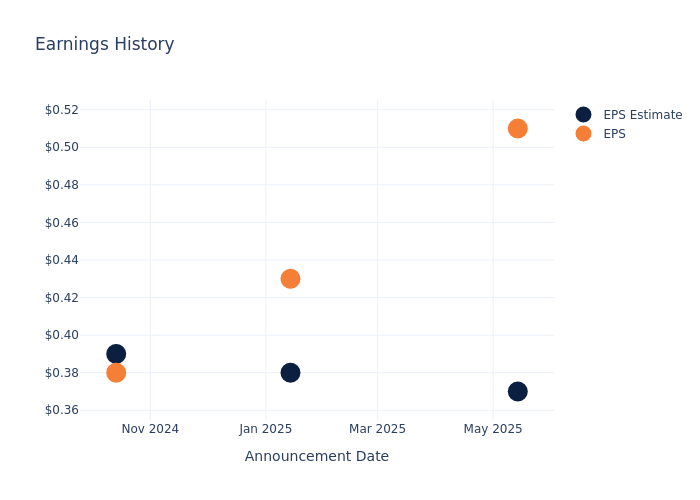

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.14, leading to a 11.92% increase in the share price the following trading session.

Here's a look at Karooooo's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.37 | 0.38 | 0.39 | 0.36 |

| EPS Actual | 0.51 | 0.43 | 0.38 | 0.38 |

| Price Change % | 12.0% | -6.0% | -16.0% | 1.0% |

Stock Performance

Shares of Karooooo were trading at $50.05 as of July 18. Over the last 52-week period, shares are up 44.05%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Karooooo

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Karooooo.

Karooooo has received a total of 3 ratings from analysts, with the consensus rating as Outperform. With an average one-year price target of $57.0, the consensus suggests a potential 13.89% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of and Karooooo, three prominent industry players, offering insights into their relative performance expectations and market positioning.

Comprehensive Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for and Karooooo, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Karooooo | Outperform | 12.05% | $868.94M | 8.19% |

Key Takeaway:

Karooooo outperforms its peers in revenue growth with a rate of 12.05%. However, it lags behind in gross profit and return on equity, with $868.94M and 8.19% respectively.

All You Need to Know About Karooooo

Karooooo Ltd is a provider of real-time mobility data analytics solutions for smart transportation. It offers a comprehensive, cloud-based smart mobility platform for connected vehicles and other assets. The company's software-as-a-service platform provides customers with differentiated insights and analytics to optimize business and workforce, increase efficiency and decrease costs, improve safety, monitor environmental impact, assist with regularity compliance, and manage risk. The segments of the group are Cartrack; Carzuka; and Karooooo Logistics, of which key revenue is derived from the Cartrack segment.

Karooooo's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Karooooo displayed positive results in 3 months. As of 28 February, 2025, the company achieved a solid revenue growth rate of approximately 12.05%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 20.55%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Karooooo's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.19% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 5.08%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.23.

To track all earnings releases for Karooooo visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.