Knight-Swift's Earnings: A Preview

Knight-Swift (NYSE:KNX) is gearing up to announce its quarterly earnings on Wednesday, 2025-07-23. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Knight-Swift will report an earnings per share (EPS) of $0.33.

The market awaits Knight-Swift's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

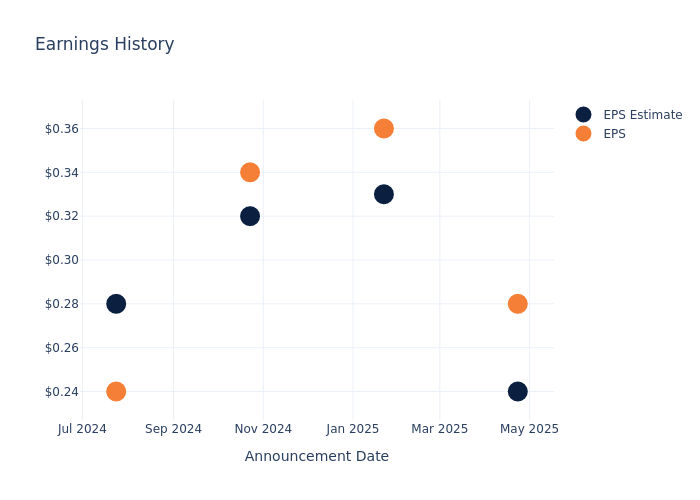

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.04, leading to a 1.94% increase in the share price the following trading session.

Here's a look at Knight-Swift's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.24 | 0.33 | 0.32 | 0.28 |

| EPS Actual | 0.28 | 0.36 | 0.34 | 0.24 |

| Price Change % | 2.0% | 5.0% | -2.0% | 6.0% |

Performance of Knight-Swift Shares

Shares of Knight-Swift were trading at $44.43 as of July 21. Over the last 52-week period, shares are down 7.64%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Observations about Knight-Swift

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Knight-Swift.

With 16 analyst ratings, Knight-Swift has a consensus rating of Outperform. The average one-year price target is $51.25, indicating a potential 15.35% upside.

Peer Ratings Overview

In this analysis, we delve into the analyst ratings and average 1-year price targets of Ryder System, Saia and Landstar System, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Ryder System, with an average 1-year price target of $179.83, suggesting a potential 304.75% upside.

- Analysts currently favor an Buy trajectory for Saia, with an average 1-year price target of $314.18, suggesting a potential 607.13% upside.

- Analysts currently favor an Neutral trajectory for Landstar System, with an average 1-year price target of $140.71, suggesting a potential 216.7% upside.

Snapshot: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Ryder System, Saia and Landstar System, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Knight-Swift | Outperform | 0.10% | $246.20M | 0.43% |

| Ryder System | Neutral | 0.71% | $616M | 3.20% |

| Saia | Buy | 4.35% | $112.76M | 2.13% |

| Landstar System | Neutral | -1.58% | $149.08M | 3.13% |

Key Takeaway:

Knight-Swift ranks at the top for Revenue Growth with a modest increase. It is at the bottom for Gross Profit, indicating lower profitability. Knight-Swift is at the bottom for Return on Equity, suggesting lower returns for shareholders. Overall, Knight-Swift's performance is mixed compared to its peers.

Unveiling the Story Behind Knight-Swift

Knight-Swift is the largest full-truckload carrier in the US, with a diversified transportation offering. Pro forma for the US Xpress deal, about 82% of revenue derives from Knight's asset-based trucking business, with full truckload (for-hire dry van, refrigerated, and dedicated contract) making up 69% and less than truckload 13%. Truck brokerage and other asset-light logistics services make up 9% of revenue, with intermodal near 6%. Knight's intermodal operations use the Class I railroads for the underlying movement of its shipping containers and include drayage (regional trucking services to and from inland intermodal ramps/terminals). The remainder of revenue reflects services offered to shippers and third-party truckers, including equipment maintenance and leasing.

Knight-Swift: Financial Performance Dissected

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Knight-Swift displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 0.1%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Knight-Swift's net margin is impressive, surpassing industry averages. With a net margin of 1.68%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Knight-Swift's ROE stands out, surpassing industry averages. With an impressive ROE of 0.43%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Knight-Swift's ROA excels beyond industry benchmarks, reaching 0.24%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.45, Knight-Swift adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Knight-Swift visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.