Earnings Preview For Stewart Information Servs

Stewart Information Servs (NYSE:STC) is set to give its latest quarterly earnings report on Wednesday, 2025-07-23. Here's what investors need to know before the announcement.

Analysts estimate that Stewart Information Servs will report an earnings per share (EPS) of $1.30.

Anticipation surrounds Stewart Information Servs's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

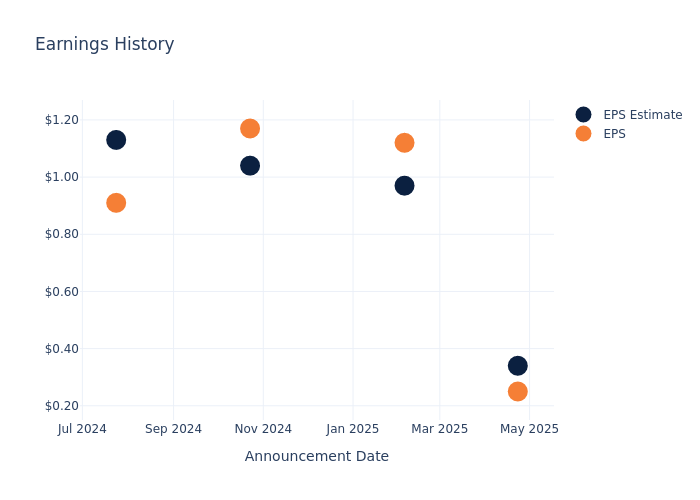

Earnings Track Record

In the previous earnings release, the company missed EPS by $0.09, leading to a 1.87% drop in the share price the following trading session.

Here's a look at Stewart Information Servs's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.34 | 0.97 | 1.04 | 1.13 |

| EPS Actual | 0.25 | 1.12 | 1.17 | 0.91 |

| Price Change % | -2.0% | 4.0% | 6.0% | -1.0% |

Stewart Information Servs Share Price Analysis

Shares of Stewart Information Servs were trading at $58.34 as of July 21. Over the last 52-week period, shares are down 19.12%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Insights Shared by Analysts on Stewart Information Servs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Stewart Information Servs.

The consensus rating for Stewart Information Servs is Neutral, based on 1 analyst ratings. With an average one-year price target of $72.0, there's a potential 23.41% upside.

Comparing Ratings Among Industry Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Trupanion, three key industry players, offering insights into their relative performance expectations and market positioning.

Overview of Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for and Trupanion, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Trupanion | Buy | 11.71% | $51.10M | -0.45% |

Key Takeaway:

Stewart Information Servs ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it is in the middle for Return on Equity. The consensus rating for Stewart Information Servs is not provided in the data.

Get to Know Stewart Information Servs Better

Stewart Information Services Corp is a customer-focused, title insurance and real estate services company offering products and services to home buyers and sellers, mortgage lenders and servicers, attorneys, and home builders. It has three operating segments; Title insurance and related services which generates key revenue, includes the functions of searching, examining, closing, and insuring the condition of the title to real property. It also includes home and personal insurance services, Real estate solutions segment supports the real estate mortgage industry by providing appraisal management services, online notarization and closing solutions, credit, and real estate information services, search and valuation services. Corporate and other segment is comprised of parent holding company.

Breaking Down Stewart Information Servs's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Stewart Information Servs showcased positive performance, achieving a revenue growth rate of 10.4% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 0.5%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Stewart Information Servs's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 0.22%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Stewart Information Servs's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.11%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.4, caution is advised due to increased financial risk.

This article was generated by Benzinga's automated content engine and reviewed by an editor.