What to Expect from Pool's Earnings

Pool (NASDAQ:POOL) is set to give its latest quarterly earnings report on Thursday, 2025-07-24. Here's what investors need to know before the announcement.

Analysts estimate that Pool will report an earnings per share (EPS) of $5.15.

Anticipation surrounds Pool's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

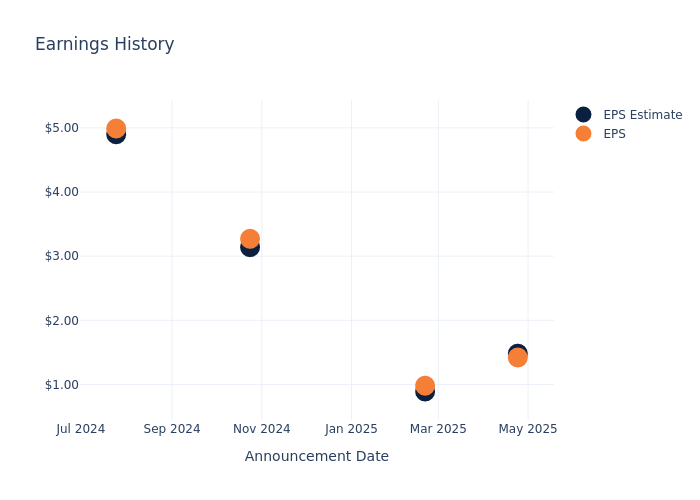

Historical Earnings Performance

Last quarter the company missed EPS by $0.06, which was followed by a 1.0% increase in the share price the next day.

Here's a look at Pool's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.48 | 0.89 | 3.14 | 4.90 |

| EPS Actual | 1.42 | 0.98 | 3.27 | 4.99 |

| Price Change % | 1.0% | -0.0% | -3.0% | 3.0% |

Market Performance of Pool's Stock

Shares of Pool were trading at $314.66 as of July 22. Over the last 52-week period, shares are down 12.32%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts' Take on Pool

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Pool.

A total of 4 analyst ratings have been received for Pool, with the consensus rating being Neutral. The average one-year price target stands at $325.5, suggesting a potential 3.44% upside.

Comparing Ratings Among Industry Peers

The analysis below examines the analyst ratings and average 1-year price targets of LKQ, Genuine Parts and A-Mark Precious Metals, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for LKQ, with an average 1-year price target of $60.0, suggesting a potential 80.93% downside.

- Analysts currently favor an Buy trajectory for Genuine Parts, with an average 1-year price target of $141.67, suggesting a potential 54.98% downside.

- Analysts currently favor an Buy trajectory for A-Mark Precious Metals, with an average 1-year price target of $31.5, suggesting a potential 89.99% downside.

Summary of Peers Analysis

The peer analysis summary presents essential metrics for LKQ, Genuine Parts and A-Mark Precious Metals, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Pool | Neutral | -4.40% | $312.37M | 4.24% |

| LKQ | Outperform | -6.48% | $1.38B | 2.77% |

| Genuine Parts | Buy | 1.43% | $2.17B | 4.42% |

| A-Mark Precious Metals | Buy | 15.26% | $41.02M | -1.36% |

Key Takeaway:

Pool is positioned in the middle among its peers for revenue growth, with a slight decline. Its gross profit is higher than one peer but lower than the other two. The return on equity for Pool is higher than two peers but lower than one.

Unveiling the Story Behind Pool

Pool Corp distributes swimming pool supplies and related products. Its products include non-discretionary pool-maintenance products, like chemicals and replacement parts, as well as pool equipment, like packaged pools (kits to build swimming pools), cleaners, filters, heaters, pumps, and lights. Customers include pool builders and remodelers, independent retail stores, and pool repair and service companies.

Understanding the Numbers: Pool's Finances

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Pool's revenue growth over a period of 3 months has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -4.4%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Pool's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.97% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Pool's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 4.24%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Pool's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.5%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 1.09, Pool faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Pool visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.