Valero Energy's Earnings Outlook

Valero Energy (NYSE:VLO) is gearing up to announce its quarterly earnings on Thursday, 2025-07-24. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Valero Energy will report an earnings per share (EPS) of $1.76.

Anticipation surrounds Valero Energy's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

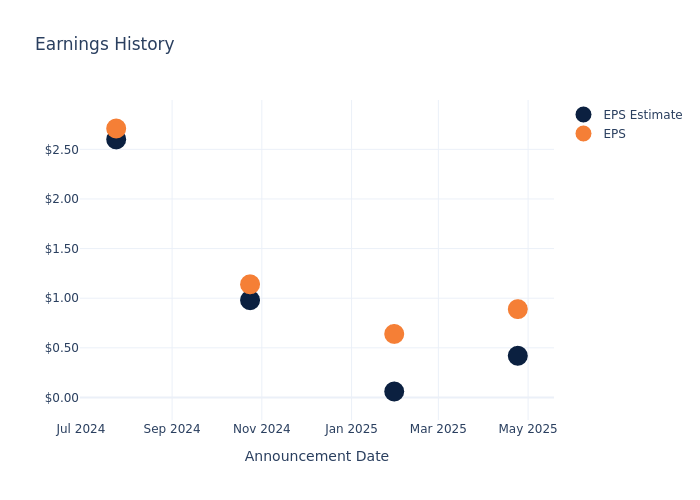

Historical Earnings Performance

Last quarter the company beat EPS by $0.47, which was followed by a 0.45% increase in the share price the next day.

Here's a look at Valero Energy's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.42 | 0.06 | 0.98 | 2.60 |

| EPS Actual | 0.89 | 0.64 | 1.14 | 2.71 |

| Price Change % | 0.0% | -2.0% | 1.0% | 1.0% |

Market Performance of Valero Energy's Stock

Shares of Valero Energy were trading at $145.11 as of July 22. Over the last 52-week period, shares are down 6.66%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Insights Shared by Analysts on Valero Energy

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Valero Energy.

A total of 18 analyst ratings have been received for Valero Energy, with the consensus rating being Outperform. The average one-year price target stands at $151.83, suggesting a potential 4.63% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Phillips 66, Marathon Petroleum and HF Sinclair, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Phillips 66, with an average 1-year price target of $135.13, suggesting a potential 6.88% downside.

- Analysts currently favor an Outperform trajectory for Marathon Petroleum, with an average 1-year price target of $182.56, suggesting a potential 25.81% upside.

- Analysts currently favor an Outperform trajectory for HF Sinclair, with an average 1-year price target of $44.82, suggesting a potential 69.11% downside.

Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Phillips 66, Marathon Petroleum and HF Sinclair, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Valero Energy | Outperform | -4.73% | $496M | -2.48% |

| Phillips 66 | Neutral | -15.03% | $1.98B | 1.77% |

| Marathon Petroleum | Outperform | -3.64% | $1.36B | -0.43% |

| HF Sinclair | Outperform | -9.35% | $190M | -0.05% |

Key Takeaway:

Valero Energy ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. Valero Energy is at the bottom for Return on Equity.

Unveiling the Story Behind Valero Energy

Valero Energy is one of the largest independent refiners in the United States. It operates 15 refineries, with a total throughput capacity of 3.2 million barrels a day in the US, Canada, and the United Kingdom. Valero also owns 12 ethanol plants with capacity of 1.6 billion gallons a year and holds a 50% stake in Diamond Green Diesel, which can produce 1.2 billion gallons per year of renewable diesel.

Breaking Down Valero Energy's Financial Performance

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Negative Revenue Trend: Examining Valero Energy's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -4.73% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Valero Energy's net margin is impressive, surpassing industry averages. With a net margin of -1.97%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -2.48%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Valero Energy's ROA stands out, surpassing industry averages. With an impressive ROA of -1.0%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Valero Energy's debt-to-equity ratio is below the industry average. With a ratio of 0.46, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Valero Energy visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.