Earnings Preview: Bread Finl Hldgs

Bread Finl Hldgs (NYSE:BFH) is set to give its latest quarterly earnings report on Thursday, 2025-07-24. Here's what investors need to know before the announcement.

Analysts estimate that Bread Finl Hldgs will report an earnings per share (EPS) of $1.86.

The announcement from Bread Finl Hldgs is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

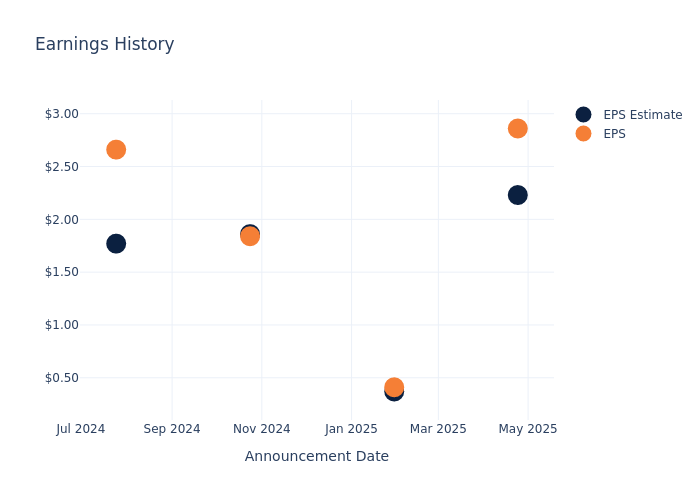

Past Earnings Performance

Last quarter the company beat EPS by $0.63, which was followed by a 0.04% drop in the share price the next day.

Here's a look at Bread Finl Hldgs's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.23 | 0.37 | 1.86 | 1.77 |

| EPS Actual | 2.86 | 0.41 | 1.84 | 2.66 |

| Price Change % | -0.0% | -1.0% | -1.0% | 5.0% |

Stock Performance

Shares of Bread Finl Hldgs were trading at $62.87 as of July 22. Over the last 52-week period, shares are up 21.17%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Opinions on Bread Finl Hldgs

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Bread Finl Hldgs.

A total of 4 analyst ratings have been received for Bread Finl Hldgs, with the consensus rating being Neutral. The average one-year price target stands at $49.0, suggesting a potential 22.06% downside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Dave, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Dave, with an average 1-year price target of $234.73, suggesting a potential 273.36% upside.

Overview of Peer Analysis

The peer analysis summary outlines pivotal metrics for and Dave, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Enova International | Buy | 22.24% | $345.64M | 6.10% |

| Dave | Buy | 46.65% | $100.87M | 15.06% |

Key Takeaway:

Bread Finl Hldgs ranks higher than peers in Revenue Growth and Gross Profit, indicating strong performance in these areas. However, it lags behind in Return on Equity, suggesting lower profitability compared to peers. Overall, Bread Finl Hldgs is positioned in the middle when compared to its peers across the analyzed metrics.

About Bread Finl Hldgs

Formed by a combination of JCPenney's credit card processing unit and The Limited's credit card bank business, Bread Financial is a provider of private-label and co-branded credit cards, loyalty programs, and marketing services. The company's most financially significant unit is its credit card business that partners with retailers to jointly market Bread's credit cards to their customers. The company also retains a minority interest in spun-off LoyaltyOne, which operates the largest airline miles loyalty program in Canada and offers marketing services to grocery chains in Europe and Asia.

Key Indicators: Bread Finl Hldgs's Financial Health

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Bread Finl Hldgs's revenue growth over a period of 3 months has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -2.12%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 14.23%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Bread Finl Hldgs's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.51%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Bread Finl Hldgs's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.61%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Bread Finl Hldgs's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.67.

To track all earnings releases for Bread Finl Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.