A Look Ahead: Sonic Automotive's Earnings Forecast

Sonic Automotive (NYSE:SAH) is gearing up to announce its quarterly earnings on Thursday, 2025-07-24. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Sonic Automotive will report an earnings per share (EPS) of $1.61.

The announcement from Sonic Automotive is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

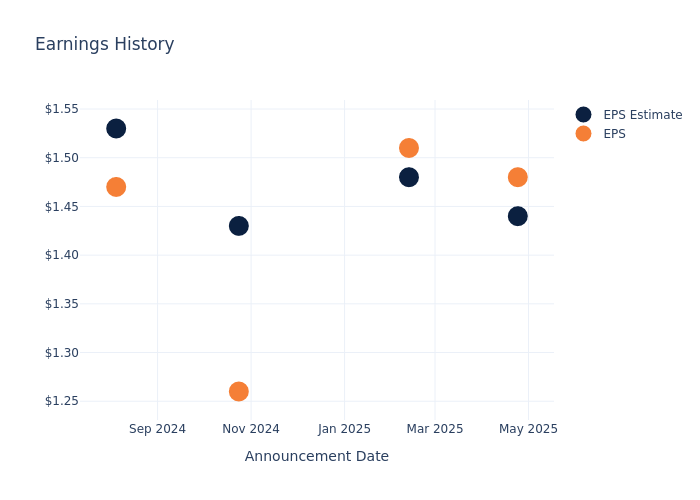

Earnings History Snapshot

Last quarter the company beat EPS by $0.04, which was followed by a 0.2% increase in the share price the next day.

Here's a look at Sonic Automotive's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.44 | 1.48 | 1.43 | 1.53 |

| EPS Actual | 1.48 | 1.51 | 1.26 | 1.47 |

| Price Change % | 0.0% | 2.0% | -1.0% | -0.0% |

Performance of Sonic Automotive Shares

Shares of Sonic Automotive were trading at $77.85 as of July 22. Over the last 52-week period, shares are up 40.16%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on Sonic Automotive

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Sonic Automotive.

With 5 analyst ratings, Sonic Automotive has a consensus rating of Buy. The average one-year price target is $79.6, indicating a potential 2.25% upside.

Comparing Ratings with Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Advance Auto Parts and Camping World Holdings, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Advance Auto Parts, with an average 1-year price target of $45.67, suggesting a potential 41.34% downside.

- Analysts currently favor an Buy trajectory for Camping World Holdings, with an average 1-year price target of $19.67, suggesting a potential 74.73% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for Advance Auto Parts and Camping World Holdings, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Sonic Automotive | Buy | 7.90% | $566.40M | 6.56% |

| Advance Auto Parts | Neutral | -6.82% | $1.11B | 1.10% |

| Camping World Holdings | Buy | 3.63% | $429.63M | -3.86% |

Key Takeaway:

Sonic Automotive ranks highest in Revenue Growth among its peers. It also leads in Gross Profit margin. However, it has the lowest Return on Equity.

Unveiling the Story Behind Sonic Automotive

Sonic Automotive is one of the largest auto dealership groups in the United States. The company has 108 franchised stores in 18 states, primarily in metropolitan areas in California, Texas, and the Southeast, plus 18 EchoPark used-vehicle stores, 16 collision centers, and 14 powersports locations. The franchise stores derive revenue from new and used vehicles plus parts and collision repair, finance, insurance, and wholesale auctions. Luxury and import dealerships make up about 86% of franchise new-vehicle revenue, while Honda, BMW, Mercedes, and Toyota constitute about 59% of new-vehicle revenue. BMW is the largest brand at about 25%. 2024's revenue was $14.2 billion, with Texas and California comprising 51% of the total. EchoPark's portion was $2.1 billion.

Financial Insights: Sonic Automotive

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Sonic Automotive showcased positive performance, achieving a revenue growth rate of 7.9% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Sonic Automotive's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 1.93%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Sonic Automotive's ROE stands out, surpassing industry averages. With an impressive ROE of 6.56%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Sonic Automotive's ROA stands out, surpassing industry averages. With an impressive ROA of 1.2%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 3.71, Sonic Automotive adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Sonic Automotive visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.