Uncovering Potential: Woodward's Earnings Preview

Woodward (NASDAQ:WWD) will release its quarterly earnings report on Monday, 2025-07-28. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Woodward to report an earnings per share (EPS) of $1.63.

The announcement from Woodward is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

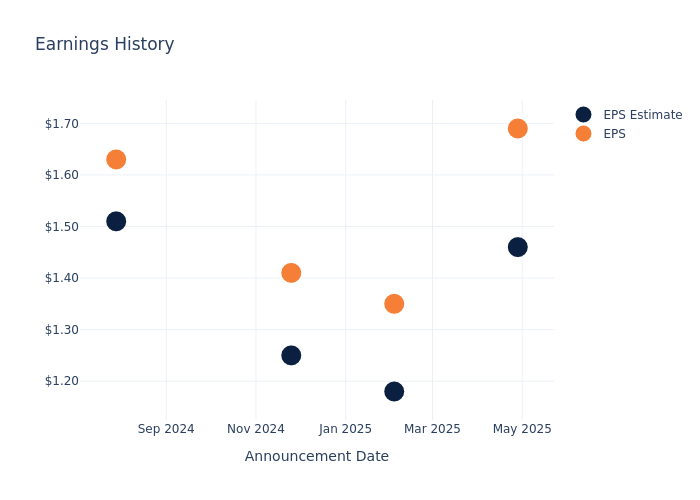

Performance in Previous Earnings

Last quarter the company beat EPS by $0.23, which was followed by a 1.86% increase in the share price the next day.

Here's a look at Woodward's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.46 | 1.18 | 1.25 | 1.51 |

| EPS Actual | 1.69 | 1.35 | 1.41 | 1.63 |

| Price Change % | 2.0% | -2.0% | 4.0% | -17.0% |

Tracking Woodward's Stock Performance

Shares of Woodward were trading at $255.245 as of July 24. Over the last 52-week period, shares are up 38.08%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Woodward

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Woodward.

A total of 8 analyst ratings have been received for Woodward, with the consensus rating being Buy. The average one-year price target stands at $249.75, suggesting a potential 2.15% downside.

Comparing Ratings with Peers

The analysis below examines the analyst ratings and average 1-year price targets of Textron, AeroVironment and ATI, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Textron, with an average 1-year price target of $84.8, suggesting a potential 66.78% downside.

- Analysts currently favor an Buy trajectory for AeroVironment, with an average 1-year price target of $266.1, suggesting a potential 4.25% upside.

- Analysts currently favor an Outperform trajectory for ATI, with an average 1-year price target of $105.0, suggesting a potential 58.86% downside.

Overview of Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Textron, AeroVironment and ATI, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Woodward | Buy | 5.78% | $240.10M | 4.79% |

| Textron | Neutral | 5.45% | $634M | 2.86% |

| AeroVironment | Buy | 39.63% | $100.33M | 1.91% |

| ATI | Outperform | 9.73% | $235.80M | 5.21% |

Key Takeaway:

Woodward ranks at the top for Revenue Growth with 5.78%. It is in the middle for Gross Profit at $240.10M. Woodward is at the top for Return on Equity with 4.79%.

Get to Know Woodward Better

Woodward Inc is an independent designer, manufacturer, and service provider of control solutions for the aerospace and industrial markets. It designs, produces, and services reliable, efficient, low-emission, and high-performance energy control products for diverse applications in challenging environments. The company operates in two segments, Aerospace and Industrial. The Aerospace segment provides fuel pumps, actuators, air valves, specialty valves, fuel nozzles, and thrust reverser actuation systems for turbine engines and nacelles, and flight deck controls, actuators, servo controls, motors, and sensors for aircraft. The Industrial segment offers actuators, valves, pumps, fuel injection systems, solenoids, ignition systems, speed controls, electronics and software, and sensors.

Financial Milestones: Woodward's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Woodward showcased positive performance, achieving a revenue growth rate of 5.78% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Woodward's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.33%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Woodward's ROE excels beyond industry benchmarks, reaching 4.79%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Woodward's ROA excels beyond industry benchmarks, reaching 2.48%. This signifies efficient management of assets and strong financial health.

Debt Management: Woodward's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.4.

To track all earnings releases for Woodward visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.