What's Next: Lithia Motors's Earnings Preview

Lithia Motors (NYSE:LAD) is set to give its latest quarterly earnings report on Tuesday, 2025-07-29. Here's what investors need to know before the announcement.

Analysts estimate that Lithia Motors will report an earnings per share (EPS) of $9.71.

The announcement from Lithia Motors is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

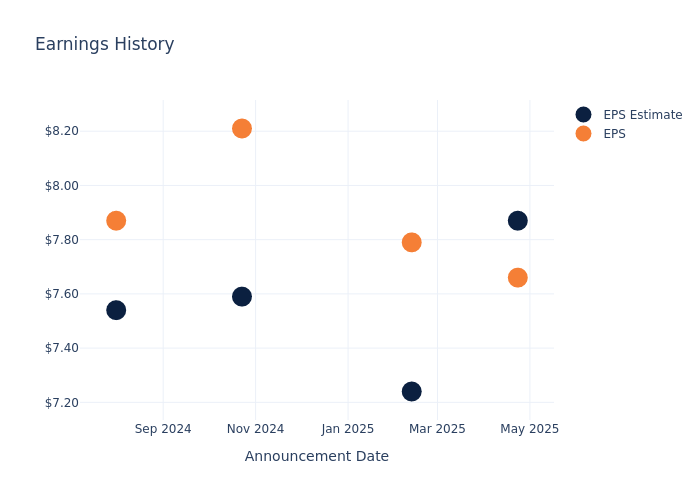

Earnings History Snapshot

In the previous earnings release, the company missed EPS by $0.21, leading to a 4.99% increase in the share price the following trading session.

Here's a look at Lithia Motors's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 7.87 | 7.24 | 7.59 | 7.54 |

| EPS Actual | 7.66 | 7.79 | 8.21 | 7.87 |

| Price Change % | 5.0% | -0.0% | 0.0% | -2.0% |

Performance of Lithia Motors Shares

Shares of Lithia Motors were trading at $312.94 as of July 25. Over the last 52-week period, shares are up 15.61%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Lithia Motors

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Lithia Motors.

Analysts have provided Lithia Motors with 3 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $399.67, suggesting a potential 27.71% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Murphy USA, AutoNation and CarMax, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Murphy USA, with an average 1-year price target of $493.33, suggesting a potential 57.64% upside.

- Analysts currently favor an Neutral trajectory for AutoNation, with an average 1-year price target of $228.33, suggesting a potential 27.04% downside.

- Analysts currently favor an Outperform trajectory for CarMax, with an average 1-year price target of $82.9, suggesting a potential 73.51% downside.

Peers Comparative Analysis Summary

The peer analysis summary presents essential metrics for Murphy USA, AutoNation and CarMax, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lithia Motors | Buy | 7.20% | $1.41B | 3.12% |

| Murphy USA | Outperform | -6.57% | $483.60M | 6.82% |

| AutoNation | Neutral | 3.16% | $1.22B | 7.22% |

| CarMax | Outperform | 6.09% | $893.62M | 3.36% |

Key Takeaway:

Lithia Motors ranks first in revenue growth among its peers. It has the highest gross profit margin. However, it has the lowest return on equity.

Unveiling the Story Behind Lithia Motors

Lithia Motors is a retailer of new and used vehicles and related services. The company offers over 50 brands of vehicles at nearly 500 stores globally across the US, Canada, and UK. The company has expanded largely through the acquisition of dealerships in smaller regional markets but now seeks to grow in any part of the US and we expect more deals over time in the US and, at times, abroad. Annual revenue in 2024 was $36.2 billion and we see over $50 billion possible in a few years. The US was 78% of 2024 revenue and the UK second at 19%, due to the 2024 Pendragon acquisition. In 2024, new vehicle sales were about 49% of total revenue. Lithia was founded in 1946, went public in 1996, and is the largest US auto dealer. It is based in Medford, Oregon.

Lithia Motors: Financial Performance Dissected

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Positive Revenue Trend: Examining Lithia Motors's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.2% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Lithia Motors's net margin excels beyond industry benchmarks, reaching 2.28%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Lithia Motors's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.12%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Lithia Motors's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.9% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 2.06.

To track all earnings releases for Lithia Motors visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.