Preview: Graphic Packaging Holding's Earnings

Graphic Packaging Holding (NYSE:GPK) is preparing to release its quarterly earnings on Tuesday, 2025-07-29. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Graphic Packaging Holding to report an earnings per share (EPS) of $0.40.

The announcement from Graphic Packaging Holding is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

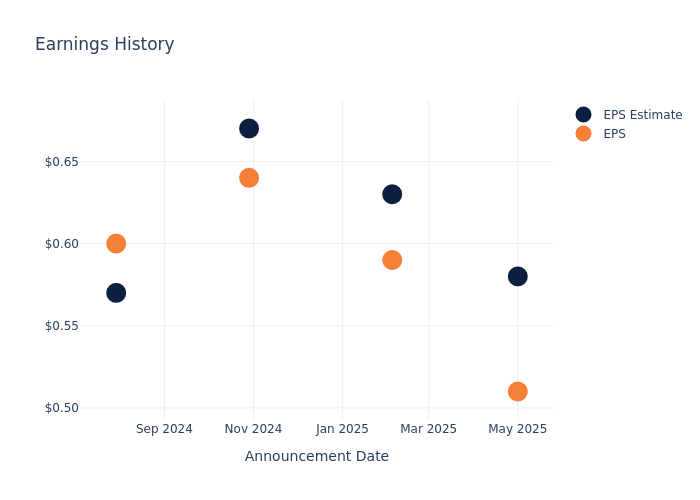

Earnings Track Record

Last quarter the company missed EPS by $0.07, which was followed by a 2.06% increase in the share price the next day.

Here's a look at Graphic Packaging Holding's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.58 | 0.63 | 0.67 | 0.57 |

| EPS Actual | 0.51 | 0.59 | 0.64 | 0.60 |

| Price Change % | 2.0% | -0.0% | -1.0% | 3.0% |

Tracking Graphic Packaging Holding's Stock Performance

Shares of Graphic Packaging Holding were trading at $23.32 as of July 25. Over the last 52-week period, shares are down 20.85%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Views on Graphic Packaging Holding

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Graphic Packaging Holding.

Graphic Packaging Holding has received a total of 7 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $25.0, the consensus suggests a potential 7.2% upside.

Peer Ratings Overview

The following analysis focuses on the analyst ratings and average 1-year price targets of Sonoco Prods, Sealed Air and Ranpak Hldgs, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Sonoco Prods, with an average 1-year price target of $53.17, suggesting a potential 128.0% upside.

- Analysts currently favor an Buy trajectory for Sealed Air, with an average 1-year price target of $39.33, suggesting a potential 68.65% upside.

- Analysts currently favor an Neutral trajectory for Ranpak Hldgs, with an average 1-year price target of $5.5, suggesting a potential 76.42% downside.

Overview of Peer Analysis

The peer analysis summary outlines pivotal metrics for Sonoco Prods, Sealed Air and Ranpak Hldgs, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Graphic Packaging Holding | Neutral | -6.15% | $445M | 4.12% |

| Sonoco Prods | Buy | 11.77% | $353.69M | 17.32% |

| Sealed Air | Buy | -4.29% | $391.70M | 15.96% |

| Ranpak Hldgs | Neutral | 6.92% | $30.90M | -2.00% |

Key Takeaway:

Graphic Packaging Holding is positioned in the middle compared to its peers in terms of consensus rating. It ranks at the bottom for revenue growth among its peers. However, it ranks at the top for gross profit. In terms of return on equity, Graphic Packaging Holding is positioned in the middle compared to its peers.

Discovering Graphic Packaging Holding: A Closer Look

Graphic Packaging Holding Co is a holding company that manufactures and sells a variety of paper-based consumer packaging products through its subsidiaries. The company's reportable segments are; Paperboard Manufacturing, Americas Paperboard Packaging, and Europe Paperboard Packaging. The majority of the revenue is generated from its Americas Paperboard Packaging segment which includes paperboard packaging sold predominantly to consumer packaged goods (CPG) companies and cups, lids and food containers sold to foodservice companies and quick-service restaurants (QSR) serving the food, beverage, and consumer product markets in the Americas. Geographically, the company generates revenue from the Americas, Europe and Asia Pacific regions.

Graphic Packaging Holding: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Graphic Packaging Holding's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -6.15% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Graphic Packaging Holding's net margin excels beyond industry benchmarks, reaching 5.99%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Graphic Packaging Holding's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.12% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.12%, the company showcases effective utilization of assets.

Debt Management: Graphic Packaging Holding's debt-to-equity ratio is below the industry average. With a ratio of 1.81, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.