Preview: Old Dominion Freight Line's Earnings

Old Dominion Freight Line (NASDAQ:ODFL) will release its quarterly earnings report on Wednesday, 2025-07-30. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Old Dominion Freight Line to report an earnings per share (EPS) of $1.29.

The market awaits Old Dominion Freight Line's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

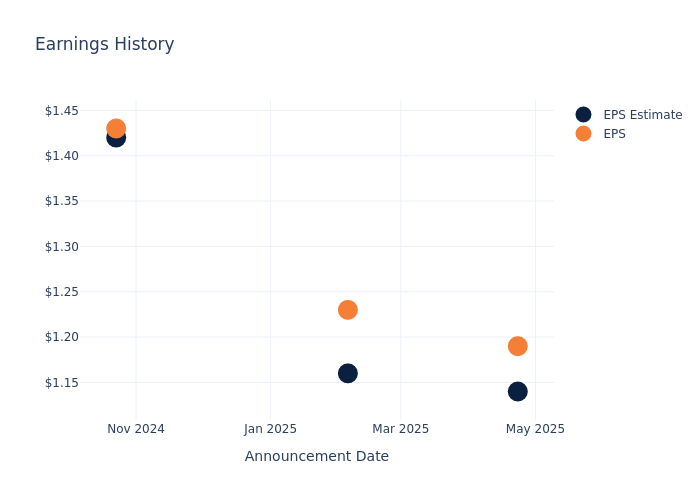

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.05, leading to a 3.7% increase in the share price the following trading session.

Here's a look at Old Dominion Freight Line's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.14 | 1.16 | 1.42 | 1.45 |

| EPS Actual | 1.19 | 1.23 | 1.43 | 1.48 |

| Price Change % | 4.0% | 1.0% | 2.0% | 6.0% |

Market Performance of Old Dominion Freight Line's Stock

Shares of Old Dominion Freight Line were trading at $164.32 as of July 28. Over the last 52-week period, shares are down 22.04%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Views on Old Dominion Freight Line

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Old Dominion Freight Line.

Old Dominion Freight Line has received a total of 8 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $172.0, the consensus suggests a potential 4.67% upside.

Peer Ratings Overview

In this analysis, we delve into the analyst ratings and average 1-year price targets of XPO and JB Hunt Transport Servs, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for XPO, with an average 1-year price target of $135.32, suggesting a potential 17.65% downside.

- Analysts currently favor an Neutral trajectory for JB Hunt Transport Servs, with an average 1-year price target of $160.24, suggesting a potential 2.48% downside.

Insights: Peer Analysis

In the peer analysis summary, key metrics for XPO and JB Hunt Transport Servs are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Old Dominion Freight Line | Neutral | -5.84% | $450.09M | 6.01% |

| XPO | Outperform | -3.17% | $207M | 4.26% |

| JB Hunt Transport Servs | Neutral | -0.02% | $513.64M | 3.42% |

Key Takeaway:

Old Dominion Freight Line ranks highest in Gross Profit among its peers. It is in the middle for Revenue Growth and Return on Equity.

Unveiling the Story Behind Old Dominion Freight Line

Old Dominion Freight Line is the second-largest less-than-truckload carrier in the United States (following FedEx Freight), with more than 250 service centers and 11,000-plus tractors. It is one of the most disciplined and efficient providers in the trucking industry, and its profitability and capital returns are head and shoulders above its peers. Strategic initiatives revolve around boosting network density through market share gains and maintaining industry-leading service (including ultralow cargo claims) via steadfast infrastructure investment.

Financial Milestones: Old Dominion Freight Line's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Old Dominion Freight Line's revenue growth over a period of 3 months has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -5.84%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Old Dominion Freight Line's net margin is impressive, surpassing industry averages. With a net margin of 18.52%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Old Dominion Freight Line's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.01% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.64%, the company showcases effective utilization of assets.

Debt Management: Old Dominion Freight Line's debt-to-equity ratio is below the industry average. With a ratio of 0.01, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.