Examining the Future: Ventas's Earnings Outlook

Ventas (NYSE:VTR) is preparing to release its quarterly earnings on Wednesday, 2025-07-30. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ventas to report an earnings per share (EPS) of $0.34.

Ventas bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

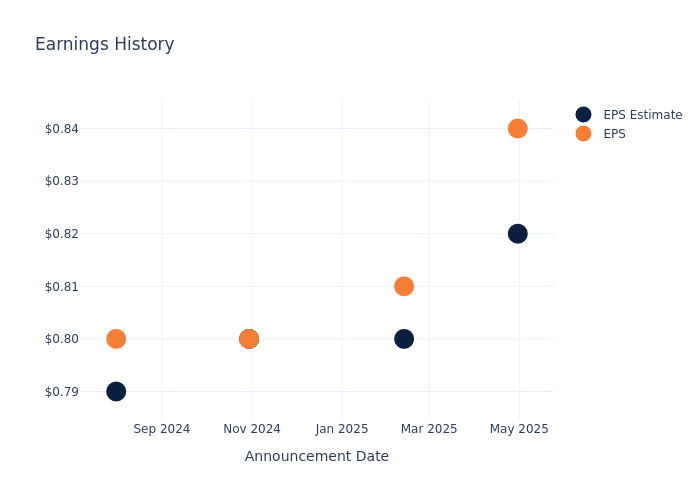

Overview of Past Earnings

Last quarter the company beat EPS by $0.02, which was followed by a 6.48% drop in the share price the next day.

Here's a look at Ventas's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.82 | 0.80 | 0.8 | 0.79 |

| EPS Actual | 0.84 | 0.81 | 0.8 | 0.80 |

| Price Change % | -6.0% | 8.0% | -1.0% | 2.0% |

Stock Performance

Shares of Ventas were trading at $65.23 as of July 28. Over the last 52-week period, shares are up 21.77%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Ventas

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Ventas.

Analysts have given Ventas a total of 3 ratings, with the consensus rating being Outperform. The average one-year price target is $73.0, indicating a potential 11.91% upside.

Comparing Ratings with Peers

The below comparison of the analyst ratings and average 1-year price targets of Alexandria Real Estate, Healthpeak Properties and Omega Healthcare Invts, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Alexandria Real Estate, with an average 1-year price target of $107.67, suggesting a potential 65.06% upside.

- Analysts currently favor an Neutral trajectory for Healthpeak Properties, with an average 1-year price target of $20.0, suggesting a potential 69.34% downside.

- Analysts currently favor an Neutral trajectory for Omega Healthcare Invts, with an average 1-year price target of $39.5, suggesting a potential 39.45% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Alexandria Real Estate, Healthpeak Properties and Omega Healthcare Invts, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ventas | Outperform | 13.18% | $572.37M | 0.42% |

| Alexandria Real Estate | Neutral | -2.37% | $512.85M | -0.63% |

| Healthpeak Properties | Neutral | -1.22% | $429.75M | 0.39% |

| Omega Healthcare Invts | Neutral | 13.76% | $273.47M | 2.35% |

Key Takeaway:

Ventas ranks highest in Revenue Growth and Gross Profit among its peers. It is at the bottom in Return on Equity.

Unveiling the Story Behind Ventas

Ventas owns a diversified healthcare portfolio of almost 1,400 in-place properties spread across the senior housing, medical office, hospital, life science, and skilled nursing/post-acute care. The portfolio includes almost 100 properties in Canada and the United Kingdom as the company looks for additional investment opportunities in countries with mature healthcare systems that operate similarly to the United States. The firm also owns mortgages and other loans, contributing about 1% of net operating income.

Ventas's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Over the 3 months period, Ventas showcased positive performance, achieving a revenue growth rate of 13.18% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Ventas's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.45%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ventas's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 0.42%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Ventas's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.18%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.13.

To track all earnings releases for Ventas visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.