Insights into Entergy's Upcoming Earnings

Entergy (NYSE:ETR) is preparing to release its quarterly earnings on Wednesday, 2025-07-30. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Entergy to report an earnings per share (EPS) of $0.91.

Entergy bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

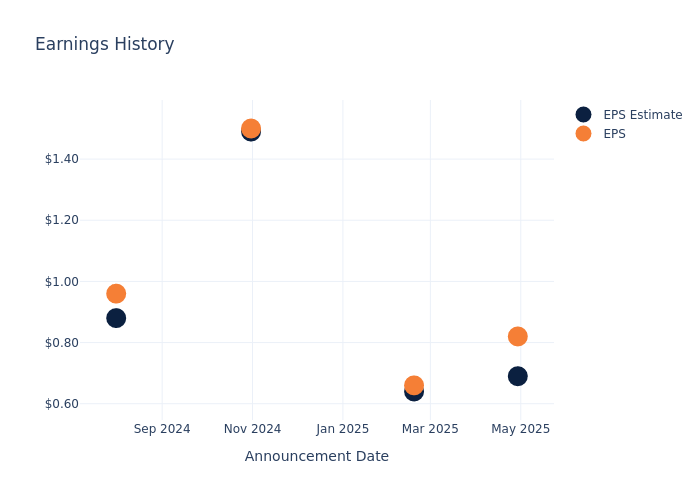

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.13, leading to a 0.43% drop in the share price on the subsequent day.

Here's a look at Entergy's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.69 | 0.64 | 1.49 | 0.88 |

| EPS Actual | 0.82 | 0.66 | 1.50 | 0.96 |

| Price Change % | -0.0% | -0.0% | -6.0% | -0.0% |

Stock Performance

Shares of Entergy were trading at $86.68 as of July 28. Over the last 52-week period, shares are up 52.27%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Entergy

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Entergy.

A total of 7 analyst ratings have been received for Entergy, with the consensus rating being Outperform. The average one-year price target stands at $89.57, suggesting a potential 3.33% upside.

Peer Ratings Comparison

The following analysis focuses on the analyst ratings and average 1-year price targets of Xcel Energy, Exelon and NRG Energy, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Xcel Energy, with an average 1-year price target of $77.5, suggesting a potential 10.59% downside.

- Analysts currently favor an Neutral trajectory for Exelon, with an average 1-year price target of $46.38, suggesting a potential 46.49% downside.

- Analysts currently favor an Buy trajectory for NRG Energy, with an average 1-year price target of $178.43, suggesting a potential 105.85% upside.

Summary of Peers Analysis

The peer analysis summary presents essential metrics for Xcel Energy, Exelon and NRG Energy, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Entergy | Outperform | 1.87% | $1.45B | 2.38% |

| Xcel Energy | Neutral | 7.04% | $1.69B | 2.46% |

| Exelon | Neutral | 11.10% | $2.85B | 3.33% |

| NRG Energy | Buy | 15.56% | $2.02B | 37.07% |

Key Takeaway:

Entergy ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, Entergy is at the bottom compared to its peers.

Get to Know Entergy Better

Entergy is a holding company with five regulated integrated utilities that generate and distribute electricity to about 3 million customers in Arkansas, Louisiana, Mississippi, and Texas. It is one of the largest power producers in the country with 24 gigawatts of rate-regulated owned and leased power generation capacity. Entergy was the second-largest nuclear owner in the US before it began retiring and selling its plants in the Northeast in 2014. It plans to sell its two small gas utilities in Louisiana.

Entergy: Financial Performance Dissected

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Entergy's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.87% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Utilities sector.

Net Margin: Entergy's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.67% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Entergy's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.38%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Entergy's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.55%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.04, caution is advised due to increased financial risk.

To track all earnings releases for Entergy visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.