A Look Ahead: Hershey's Earnings Forecast

Hershey (NYSE:HSY) is set to give its latest quarterly earnings report on Wednesday, 2025-07-30. Here's what investors need to know before the announcement.

Analysts estimate that Hershey will report an earnings per share (EPS) of $1.01.

Anticipation surrounds Hershey's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.14, leading to a 2.26% drop in the share price on the subsequent day.

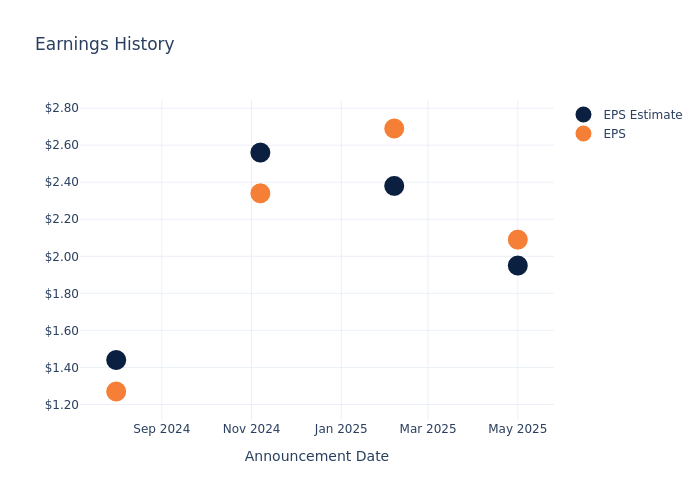

Here's a look at Hershey's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.95 | 2.38 | 2.56 | 1.44 |

| EPS Actual | 2.09 | 2.69 | 2.34 | 1.27 |

| Price Change % | -2.0% | 2.0% | 2.0% | -0.0% |

Stock Performance

Shares of Hershey were trading at $184.56 as of July 28. Over the last 52-week period, shares are down 5.47%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analysts' Perspectives on Hershey

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Hershey.

Hershey has received a total of 8 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $164.75, the consensus suggests a potential 10.73% downside.

Comparing Ratings Among Industry Peers

The below comparison of the analyst ratings and average 1-year price targets of Kraft Heinz, Kellanova and General Mills, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Kraft Heinz, with an average 1-year price target of $28.0, suggesting a potential 84.83% downside.

- Analysts currently favor an Neutral trajectory for Kellanova, with an average 1-year price target of $83.5, suggesting a potential 54.76% downside.

- Analysts currently favor an Neutral trajectory for General Mills, with an average 1-year price target of $55.33, suggesting a potential 70.02% downside.

Analysis Summary for Peers

Within the peer analysis summary, vital metrics for Kraft Heinz, Kellanova and General Mills are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Hershey | Neutral | -13.75% | $944.27M | 4.77% |

| Kraft Heinz | Neutral | -6.43% | $2.06B | 1.44% |

| Kellanova | Neutral | -3.66% | $1.06B | 7.91% |

| General Mills | Neutral | -3.35% | $1.47B | 3.07% |

Key Takeaway:

Hershey ranks at the top for Gross Profit and Return on Equity among its peers. However, it ranks at the bottom for Revenue Growth.

Discovering Hershey: A Closer Look

Hershey is a leading US confectionery manufacturer (around a $54 billion market, according to Euromonitor), controlling around 36% of the domestic chocolate space. Beyond its namesake label, the firm's mix has expanded over the last 85 years and now consists of 100 brands, including Reese's, Kit Kat, Kisses, and Ice Breakers. Hershey's products are sold in about 80 countries, albeit with just a high-single-digit percentage of sales coming from markets outside the US, including Brazil, India, and Mexico. The firm has sought inorganic opportunities to extend its reach beyond its core confection business, adding Amplify Snack Brands and its Skinny Pop ready-to-eat popcorn to its mix, Pirate Brands, and Dot's Pretzels over the past few years.

Hershey: A Financial Overview

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Negative Revenue Trend: Examining Hershey's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -13.75% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Staples sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Hershey's net margin is impressive, surpassing industry averages. With a net margin of 7.99%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Hershey's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.77% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.67%, the company showcases effective utilization of assets.

Debt Management: Hershey's debt-to-equity ratio surpasses industry norms, standing at 1.34. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Hershey visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.