Virtu Finl's Earnings Outlook

Virtu Finl (NASDAQ:VIRT) will release its quarterly earnings report on Wednesday, 2025-07-30. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Virtu Finl to report an earnings per share (EPS) of $1.31.

The announcement from Virtu Finl is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

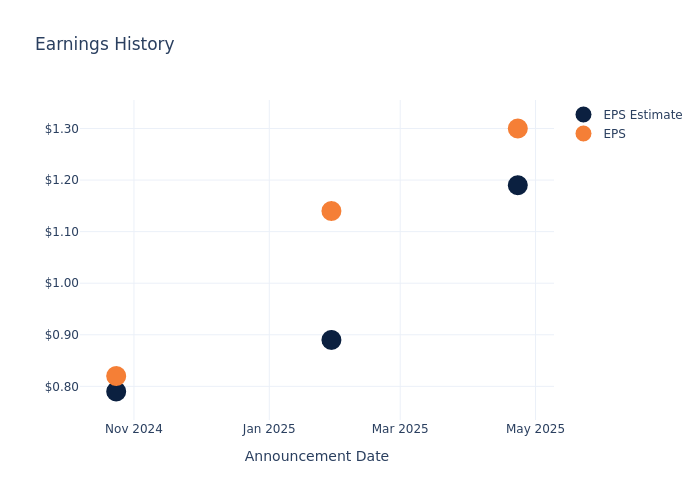

Historical Earnings Performance

The company's EPS beat by $0.11 in the last quarter, leading to a 1.46% drop in the share price on the following day.

Here's a look at Virtu Finl's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.19 | 0.89 | 0.79 | 0.60 |

| EPS Actual | 1.30 | 1.14 | 0.82 | 0.83 |

| Price Change % | -1.0% | 0.0% | 0.0% | 6.0% |

Tracking Virtu Finl's Stock Performance

Shares of Virtu Finl were trading at $43.4 as of July 28. Over the last 52-week period, shares are up 60.58%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Virtu Finl

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Virtu Finl.

A total of 3 analyst ratings have been received for Virtu Finl, with the consensus rating being Neutral. The average one-year price target stands at $42.0, suggesting a potential 3.23% downside.

Analyzing Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of PJT Partners, Marex Group and Lazard, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for PJT Partners, with an average 1-year price target of $180.0, suggesting a potential 314.75% upside.

- Analysts currently favor an Outperform trajectory for Marex Group, with an average 1-year price target of $51.33, suggesting a potential 18.27% upside.

- Analysts currently favor an Neutral trajectory for Lazard, with an average 1-year price target of $51.25, suggesting a potential 18.09% upside.

Peer Metrics Summary

The peer analysis summary outlines pivotal metrics for PJT Partners, Marex Group and Lazard, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Virtu Finl | Neutral | 30.34% | $496.64M | 7.28% |

| PJT Partners | Neutral | -1.48% | $103.39M | 32.17% |

| Marex Group | Outperform | 28.23% | $321M | 7.17% |

| Lazard | Neutral | 16.23% | $288.75M | 8.10% |

Key Takeaway:

Virtu Finl ranks at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity. Overall, Virtu Finl is positioned well compared to its peers in terms of financial performance metrics.

Get to Know Virtu Finl Better

Virtu Financial Inc is a financial firm that leverages technology to deliver liquidity to the world-wide markets and transparent trading solutions to its clients. The company's operating segment includes Market Making; and Execution Services. The non-operating segment of the company includes the Corporate segment. The company generates maximum revenue from the market-making segment. The Market Making segment principally consists of market-making in the cash, futures, and options markets across equities, options, fixed income, currencies, and commodities. Geographically, it derives a majority of its revenue from the United States and also has a presence in Ireland and Other Countries.

Virtu Finl's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Virtu Finl displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 30.34%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Virtu Finl's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 11.14%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Virtu Finl's ROE excels beyond industry benchmarks, reaching 7.28%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Virtu Finl's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.57%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 5.99, Virtu Finl faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Virtu Finl visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.