Earnings Outlook For Hawkins

Hawkins (NASDAQ:HWKN) is set to give its latest quarterly earnings report on Wednesday, 2025-07-30. Here's what investors need to know before the announcement.

Analysts estimate that Hawkins will report an earnings per share (EPS) of $1.34.

Hawkins bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

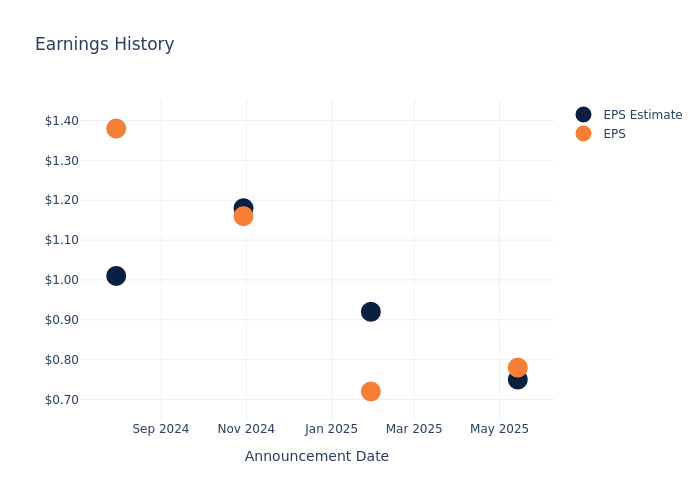

Past Earnings Performance

Last quarter the company beat EPS by $0.03, which was followed by a 0.71% drop in the share price the next day.

Here's a look at Hawkins's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.75 | 0.92 | 1.18 | 1.01 |

| EPS Actual | 0.78 | 0.72 | 1.16 | 1.38 |

| Price Change % | -1.0% | -8.0% | -9.0% | 17.0% |

Market Performance of Hawkins's Stock

Shares of Hawkins were trading at $160.85 as of July 28. Over the last 52-week period, shares are up 53.63%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Hawkins

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Hawkins.

The consensus rating for Hawkins is Buy, derived from 1 analyst ratings. An average one-year price target of $160.0 implies a potential 0.53% downside.

Comparing Ratings with Peers

The below comparison of the analyst ratings and average 1-year price targets of Olin, Tronox Holdings and Kronos Worldwide, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Olin, with an average 1-year price target of $23.6, suggesting a potential 85.33% downside.

- Analysts currently favor an Buy trajectory for Tronox Holdings, with an average 1-year price target of $7.2, suggesting a potential 95.52% downside.

- Analysts currently favor an Sell trajectory for Kronos Worldwide, with an average 1-year price target of $7.75, suggesting a potential 95.18% downside.

Insights: Peer Analysis

Within the peer analysis summary, vital metrics for Olin, Tronox Holdings and Kronos Worldwide are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Hawkins | Buy | 10.00% | $52.24M | 3.56% |

| Olin | Neutral | 0.54% | $148.70M | 0.06% |

| Tronox Holdings | Buy | -4.65% | $99M | -6.46% |

| Kronos Worldwide | Sell | 2.30% | $106.80M | 2.18% |

Key Takeaway:

Hawkins ranks highest in Revenue Growth among its peers. It also leads in Gross Profit. However, it has the lowest Return on Equity.

Delving into Hawkins's Background

Hawkins Inc manufactures and sells a variety of chemicals and ingredients. The firm organizes itself into three segments based on the product type. The industrial segment, which generates the majority of revenue, sells private label bleach, caustic soda, sulfuric acid, hydrochloric acid, phosphoric acid, potassium hydroxide, and aqua ammonia. The water treatment segment sells chemicals and equipment used to treat potable water, municipal and industrial wastewater, industrial process water, and non-residential swimming pool water. The health and nutrition segment sells ingredients to food, beverage, personal care, and dietary supplement producers. The majority of revenue is gained from Water Treatment.

Key Indicators: Hawkins's Financial Health

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Hawkins's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 10.0%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Hawkins's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 6.66%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.56%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Hawkins's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.21%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.35.

To track all earnings releases for Hawkins visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.