Uncovering Potential: SiteOne Landscape Supply's Earnings Preview

SiteOne Landscape Supply (NYSE:SITE) is gearing up to announce its quarterly earnings on Wednesday, 2025-07-30. Here's a quick overview of what investors should know before the release.

Analysts are estimating that SiteOne Landscape Supply will report an earnings per share (EPS) of $2.92.

The market awaits SiteOne Landscape Supply's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

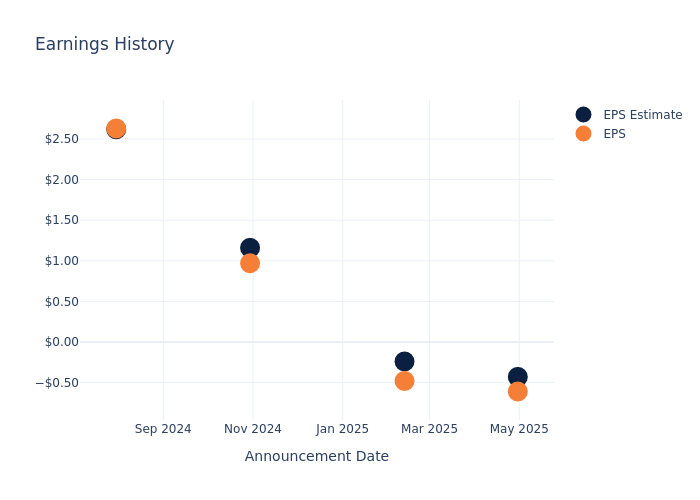

Performance in Previous Earnings

During the last quarter, the company reported an EPS missed by $0.18, leading to a 1.83% increase in the share price on the subsequent day.

Here's a look at SiteOne Landscape Supply's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.43 | -0.24 | 1.16 | 2.62 |

| EPS Actual | -0.61 | -0.48 | 0.97 | 2.63 |

| Price Change % | 2.0% | 3.0% | -6.0% | -5.0% |

SiteOne Landscape Supply Share Price Analysis

Shares of SiteOne Landscape Supply were trading at $131.0 as of July 28. Over the last 52-week period, shares are down 12.35%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Observations about SiteOne Landscape Supply

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on SiteOne Landscape Supply.

Analysts have given SiteOne Landscape Supply a total of 3 ratings, with the consensus rating being Neutral. The average one-year price target is $131.67, indicating a potential 0.51% upside.

Peer Ratings Overview

The following analysis focuses on the analyst ratings and average 1-year price targets of Air Lease, MSC Industrial Direct Co and Herc Holdings, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Air Lease, with an average 1-year price target of $67.5, suggesting a potential 48.47% downside.

- Analysts currently favor an Neutral trajectory for MSC Industrial Direct Co, with an average 1-year price target of $89.5, suggesting a potential 31.68% downside.

- Analysts currently favor an Buy trajectory for Herc Holdings, with an average 1-year price target of $140.0, suggesting a potential 6.87% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Air Lease, MSC Industrial Direct Co and Herc Holdings, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| SiteOne Landscape Supply | Neutral | 3.82% | $309.80M | -1.75% |

| Air Lease | Buy | 11.30% | $230.69M | 4.74% |

| MSC Industrial Direct Co | Neutral | -0.84% | $397.74M | 4.17% |

| Herc Holdings | Buy | 7.09% | $278M | -1.31% |

Key Takeaway:

SiteOne Landscape Supply ranks in the middle for consensus recommendation. It is at the bottom for revenue growth. It is at the bottom for gross profit. It is at the bottom for return on equity.

Unveiling the Story Behind SiteOne Landscape Supply

SiteOne Landscape Supply Inc is a supplier of tools and equipment. The company serves various businesses which include wholesale irrigation, outdoor lighting, nursery, landscape supplies, grass seeds, and fertilizers, turf protection products, turf care equipment, and golf course accessories for green industry professionals mainly in the United States and Canada. Its product portfolio includes irrigation supplies, fertilizer and herbicides, landscape accessories, nursery goods, natural stones and blocks, outdoor lighting and ice melt products and other products.

SiteOne Landscape Supply: A Financial Overview

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: SiteOne Landscape Supply's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 3.82%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -2.91%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -1.75%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): SiteOne Landscape Supply's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.86%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.69.

This article was generated by Benzinga's automated content engine and reviewed by an editor.