Earnings Preview: Materion

Materion (NYSE:MTRN) is set to give its latest quarterly earnings report on Wednesday, 2025-07-30. Here's what investors need to know before the announcement.

Analysts estimate that Materion will report an earnings per share (EPS) of $1.15.

The market awaits Materion's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

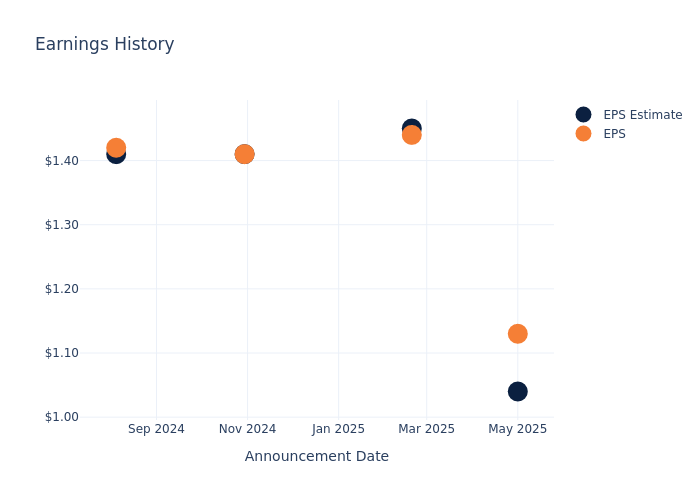

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.09, leading to a 2.75% drop in the share price the following trading session.

Here's a look at Materion's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.04 | 1.45 | 1.41 | 1.41 |

| EPS Actual | 1.13 | 1.44 | 1.41 | 1.42 |

| Price Change % | -3.0% | -3.0% | -3.0% | 11.0% |

Performance of Materion Shares

Shares of Materion were trading at $93.92 as of July 28. Over the last 52-week period, shares are down 23.56%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Observations about Materion

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Materion.

A total of 1 analyst ratings have been received for Materion, with the consensus rating being Outperform. The average one-year price target stands at $112.0, suggesting a potential 19.25% upside.

Analyzing Analyst Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Ivanhoe Electric, Compass Minerals Intl and Nexa Res, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Ivanhoe Electric, with an average 1-year price target of $14.0, suggesting a potential 85.09% downside.

- Analysts currently favor an Buy trajectory for Compass Minerals Intl, with an average 1-year price target of $21.0, suggesting a potential 77.64% downside.

- Analysts currently favor an Underperform trajectory for Nexa Res, with an average 1-year price target of $5.0, suggesting a potential 94.68% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary outlines pivotal metrics for Ivanhoe Electric, Compass Minerals Intl and Nexa Res, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Materion | Outperform | 9.10% | $76.18M | 2.01% |

| Ivanhoe Electric | Outperform | 104.17% | $442K | -10.60% |

| Compass Minerals Intl | Buy | 35.88% | $76.80M | -12.81% |

| Nexa Res | Underperform | 8.16% | $126.56M | 1.41% |

Key Takeaway:

Materion ranks at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity.

Delving into Materion's Background

Materion Corp specializes in the development of specialty engineered alloy systems, inorganic chemicals and powders, precious and non-precious metals, beryllium and beryllium composites, and precision filters and optical coatings. The company operates in four reportable segments: Performance Materials, Electronic Materials, Precision Optics, and Others. The majority of revenue is derived from Electronic Materials which produces chemicals, microelectronics packaging, precious metal, non-precious metal, and specialty metal products, including vapor deposition targets, frame lid assemblies, clad and precious metal pre-forms. The Performance Materials segment provides engineered solutions comprised of beryllium and non-beryllium-containing alloy systems and custom-engineered parts.

Financial Milestones: Materion's Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Materion's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 9.1% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Materion's net margin is impressive, surpassing industry averages. With a net margin of 4.21%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Materion's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.01%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.03%, the company showcases effective utilization of assets.

Debt Management: Materion's debt-to-equity ratio is below the industry average at 0.6, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Materion visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.