Insights Ahead: Monolithic Power Systems's Quarterly Earnings

Monolithic Power Systems (NASDAQ:MPWR) is set to give its latest quarterly earnings report on Thursday, 2025-07-31. Here's what investors need to know before the announcement.

Analysts estimate that Monolithic Power Systems will report an earnings per share (EPS) of $3.69.

Investors in Monolithic Power Systems are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

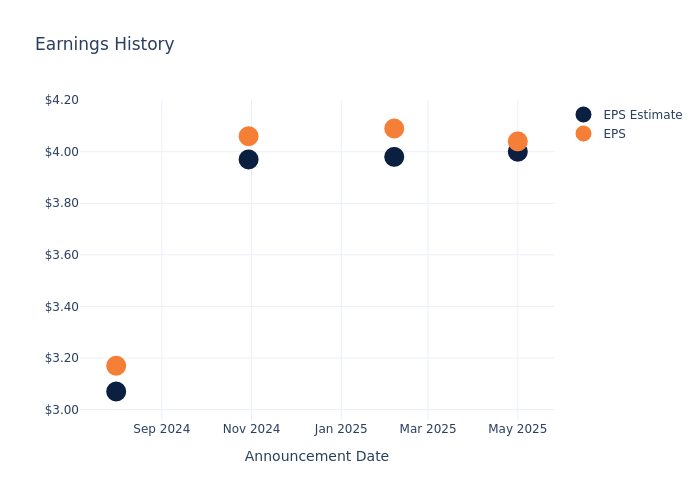

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.04, leading to a 5.86% increase in the share price the following trading session.

Here's a look at Monolithic Power Systems's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 4 | 3.98 | 3.97 | 3.07 |

| EPS Actual | 4.04 | 4.09 | 4.06 | 3.17 |

| Price Change % | 6.0% | 9.0% | -17.0% | 1.0% |

Stock Performance

Shares of Monolithic Power Systems were trading at $724.37 as of July 29. Over the last 52-week period, shares are down 6.76%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Monolithic Power Systems

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Monolithic Power Systems.

Analysts have provided Monolithic Power Systems with 11 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $766.73, suggesting a potential 5.85% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Microchip Technology, ON Semiconductor and GLOBALFOUNDRIES, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Microchip Technology, with an average 1-year price target of $72.55, suggesting a potential 89.98% downside.

- Analysts currently favor an Neutral trajectory for ON Semiconductor, with an average 1-year price target of $56.14, suggesting a potential 92.25% downside.

- Analysts currently favor an Neutral trajectory for GLOBALFOUNDRIES, with an average 1-year price target of $43.0, suggesting a potential 94.06% downside.

Summary of Peers Analysis

The peer analysis summary presents essential metrics for Microchip Technology, ON Semiconductor and GLOBALFOUNDRIES, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Monolithic Power Systems | Buy | 39.24% | $353.23M | 4.17% |

| Microchip Technology | Buy | -26.80% | $501.10M | -2.39% |

| ON Semiconductor | Neutral | -22.39% | $293.80M | -5.78% |

| GLOBALFOUNDRIES | Neutral | 2.32% | $355M | 1.92% |

Key Takeaway:

Monolithic Power Systems ranks highest in Revenue Growth among its peers. It also leads in Gross Profit margin. However, it has a lower Return on Equity compared to some peers. Overall, Monolithic Power Systems is positioned favorably compared to its peers in the analysis.

Get to Know Monolithic Power Systems Better

Monolithic Power Systems is an analog and mixed-signal chipmaker, specializing in power management solutions. The firm's mission is to reduce total energy consumption in end systems, and it serves the computing, automotive, industrial, communications, and consumer end markets. MPS uses a fabless manufacturing model, partnering with third-party chip foundries to host its proprietary BCD process technology.

Monolithic Power Systems's Economic Impact: An Analysis

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Monolithic Power Systems's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 39.24%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Monolithic Power Systems's net margin excels beyond industry benchmarks, reaching 20.98%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Monolithic Power Systems's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.17% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Monolithic Power Systems's ROA stands out, surpassing industry averages. With an impressive ROA of 3.6%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Monolithic Power Systems's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.0.

This article was generated by Benzinga's automated content engine and reviewed by an editor.