What's Next: Affiliated Managers Group's Earnings Preview

Affiliated Managers Group (NYSE:AMG) is set to give its latest quarterly earnings report on Thursday, 2025-07-31. Here's what investors need to know before the announcement.

Analysts estimate that Affiliated Managers Group will report an earnings per share (EPS) of $5.27.

Investors in Affiliated Managers Group are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

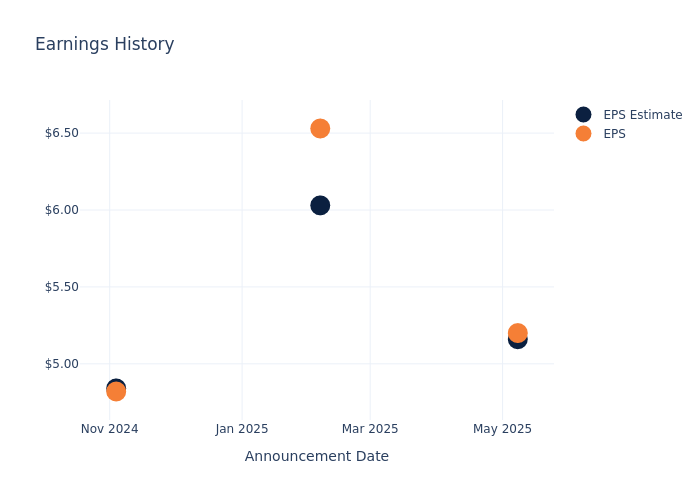

Past Earnings Performance

Last quarter the company beat EPS by $0.04, which was followed by a 1.1% drop in the share price the next day.

Here's a look at Affiliated Managers Group's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 5.16 | 6.03 | 4.84 | 4.60 |

| EPS Actual | 5.20 | 6.53 | 4.82 | 4.67 |

| Price Change % | -1.0% | -2.0% | 0.0% | 1.0% |

Performance of Affiliated Managers Group Shares

Shares of Affiliated Managers Group were trading at $211.21 as of July 29. Over the last 52-week period, shares are up 18.63%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Affiliated Managers Group

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Affiliated Managers Group.

With 3 analyst ratings, Affiliated Managers Group has a consensus rating of Buy. The average one-year price target is $211.67, indicating a potential 0.22% upside.

Comparing Ratings with Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Hamilton Lane, Janus Henderson Group and StepStone Group, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Hamilton Lane, with an average 1-year price target of $157.8, suggesting a potential 25.29% downside.

- Analysts currently favor an Neutral trajectory for Janus Henderson Group, with an average 1-year price target of $39.0, suggesting a potential 81.53% downside.

- Analysts currently favor an Neutral trajectory for StepStone Group, with an average 1-year price target of $66.75, suggesting a potential 68.4% downside.

Peers Comparative Analysis Summary

In the peer analysis summary, key metrics for Hamilton Lane, Janus Henderson Group and StepStone Group are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Affiliated Managers Group | Buy | -0.66% | $266.30M | 2.22% |

| Hamilton Lane | Neutral | 12.06% | $133.25M | 7.39% |

| Janus Henderson Group | Neutral | 12.63% | $423.80M | 2.55% |

| StepStone Group | Neutral | 5.86% | $163.48M | -9.51% |

Key Takeaway:

Affiliated Managers Group ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. The company is at the top for Return on Equity.

Delving into Affiliated Managers Group's Background

Affiliated Managers Group offers investment strategies to investors through its network of affiliates. The firm typically buys a majority interest in small to mid-size boutique asset managers, receiving a fixed percentage of revenue from these firms in return. Affiliates operate independently, with AMG providing strategic, operational, and technology support, as well as global distribution. At the end of March 2025, AMG's affiliate network—which includes firms like Abacus Capital and Pantheon dedicated to private markets (which accounted for 20% of AUM), AQR Capital and Capula Investment Management in liquid alternatives (22%), and Harding Loevner, Tweedy Browne, Parnassus, and Yacktman in equities, multi-asset, and bond strategies (58%)—had $712 billion in managed assets.

A Deep Dive into Affiliated Managers Group's Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Affiliated Managers Group's revenue growth over a period of 3 months has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -0.66%. This indicates a decrease in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Affiliated Managers Group's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 14.58%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.22%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Affiliated Managers Group's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.83%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Affiliated Managers Group's debt-to-equity ratio is below the industry average at 0.82, reflecting a lower dependency on debt financing and a more conservative financial approach.

This article was generated by Benzinga's automated content engine and reviewed by an editor.