Examining the Future: Montrose Environmental Gr's Earnings Outlook

Montrose Environmental Gr (NYSE:MEG) is preparing to release its quarterly earnings on Wednesday, 2025-05-07. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Montrose Environmental Gr to report an earnings per share (EPS) of $-0.09.

Investors in Montrose Environmental Gr are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

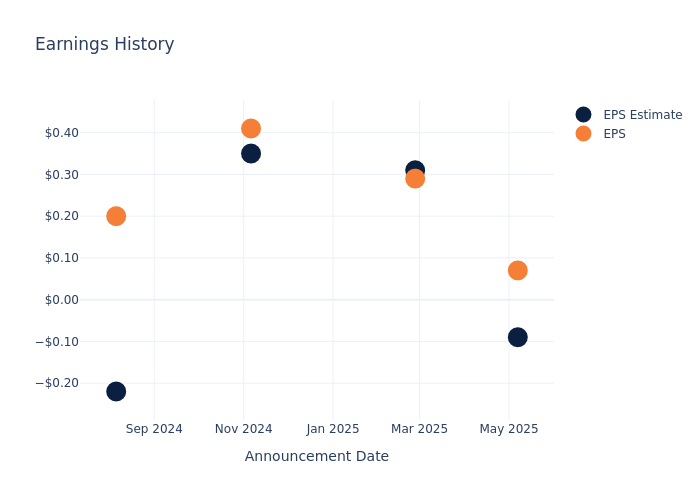

Earnings Track Record

Last quarter the company missed EPS by $0.02, which was followed by a 32.63% increase in the share price the next day.

Here's a look at Montrose Environmental Gr's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.09 | 0.31 | 0.35 | -0.22 |

| EPS Actual | 0.07 | 0.29 | 0.41 | 0.20 |

| Price Change % | 18.0% | 33.0% | -3.0% | 0.0% |

Stock Performance

Shares of Montrose Environmental Gr were trading at $22.39 as of July 29. Over the last 52-week period, shares are down 25.24%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts' Perspectives on Montrose Environmental Gr

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Montrose Environmental Gr.

A total of 1 analyst ratings have been received for Montrose Environmental Gr, with the consensus rating being Buy. The average one-year price target stands at $30.0, suggesting a potential 33.99% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of CECO Environmental, Mobile Infrastructure and BrightView Hldgs, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for CECO Environmental, with an average 1-year price target of $49.5, suggesting a potential 121.08% upside.

- Analysts currently favor an Outperform trajectory for Mobile Infrastructure, with an average 1-year price target of $6.5, suggesting a potential 70.97% downside.

- Analysts currently favor an Buy trajectory for BrightView Hldgs, with an average 1-year price target of $19.5, suggesting a potential 12.91% downside.

Key Findings: Peer Analysis Summary

Within the peer analysis summary, vital metrics for CECO Environmental, Mobile Infrastructure and BrightView Hldgs are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Montrose Environmental Gr | Buy | 14.49% | $69.43M | -4.97% |

| CECO Environmental | Buy | 39.87% | $62.16M | 13.49% |

| Mobile Infrastructure | Outperform | -6.71% | $4.46M | -2.49% |

| BrightView Hldgs | Buy | -1.53% | $147.50M | -0.19% |

Key Takeaway:

Montrose Environmental Gr ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is at the top for Return on Equity.

Delving into Montrose Environmental Gr's Background

Montrose Environmental Group Inc is an environmental services company. The firm's operating segments are Assessment, Permitting and Response, Measurement and Analysis, and Remediation and Reuse. Through its Assessment, Permitting, and Response segment, the company provides scientific advisory and consulting services to support environmental assessments, environmental emergency response, and environmental audits. Measurement and Analysis include test and analysis of air, water, and soil to determine concentrations of contaminants whereas, the Remediation and Reuse segment provide clients with engineering, design, implementation, operations and maintenance services, to treat contaminated water, remove contaminant or create biogas. United States Contributes the majority of geographic revenue.

Financial Milestones: Montrose Environmental Gr's Journey

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Montrose Environmental Gr's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 14.49%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Montrose Environmental Gr's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -12.43%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Montrose Environmental Gr's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -4.97%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -2.23%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Montrose Environmental Gr's debt-to-equity ratio is below the industry average at 0.68, reflecting a lower dependency on debt financing and a more conservative financial approach.

This article was generated by Benzinga's automated content engine and reviewed by an editor.