Insights into Ramaco Resources's Upcoming Earnings

Ramaco Resources (NASDAQ:METC) is set to give its latest quarterly earnings report on Thursday, 2025-07-31. Here's what investors need to know before the announcement.

Analysts estimate that Ramaco Resources will report an earnings per share (EPS) of $-0.21.

The announcement from Ramaco Resources is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.03, leading to a 10.0% increase in the share price on the subsequent day.

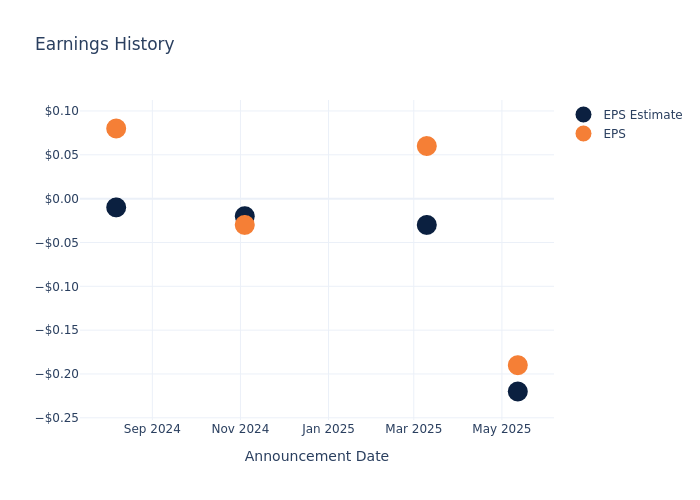

Here's a look at Ramaco Resources's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.22 | -0.03 | -0.02 | -0.01 |

| EPS Actual | -0.19 | 0.06 | -0.03 | 0.08 |

| Price Change % | 10.0% | 38.0% | 10.0% | 13.0% |

Market Performance of Ramaco Resources's Stock

Shares of Ramaco Resources were trading at $20.77 as of July 29. Over the last 52-week period, shares are up 51.11%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Perspectives on Ramaco Resources

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Ramaco Resources.

The consensus rating for Ramaco Resources is Buy, derived from 2 analyst ratings. An average one-year price target of $20.5 implies a potential 1.3% downside.

Peer Ratings Overview

The below comparison of the analyst ratings and average 1-year price targets of Alpha Metallurgical, Olympic Steel and Warrior Met Coal, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Alpha Metallurgical, with an average 1-year price target of $154.67, suggesting a potential 644.68% upside.

- Analysts currently favor an Outperform trajectory for Olympic Steel, with an average 1-year price target of $41.0, suggesting a potential 97.4% upside.

- Analysts currently favor an Buy trajectory for Warrior Met Coal, with an average 1-year price target of $62.0, suggesting a potential 198.51% upside.

Summary of Peers Analysis

In the peer analysis summary, key metrics for Alpha Metallurgical, Olympic Steel and Warrior Met Coal are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ramaco Resources | Buy | -22.02% | $20.52M | -2.63% |

| Alpha Metallurgical | Buy | -38.44% | $-17.89M | -2.08% |

| Olympic Steel | Outperform | -6.40% | $118.44M | 0.44% |

| Warrior Met Coal | Buy | -40.43% | $1.06M | -0.39% |

Key Takeaway:

Ramaco Resources ranks at the top for Revenue Growth among its peers. It is at the bottom for Gross Profit and Return on Equity.

Get to Know Ramaco Resources Better

Ramaco Resources Inc is a United States-based company that operates as a pure-play metallurgical coal company with operations in southern West Virginia and southwestern Virginia. Its portfolio includes high-quality metallurgical coal reserves & resources, with a focus on properties such as Elk Creek, Berwind, Knox Creek, and Maben. These properties are strategically located to serve North American blast furnace steel mills and coke plants, as well as international metallurgical coal consumers. Additionally, the company controls mineral deposits in Sheridan, Wyoming, exploring potential opportunities in rare earth elements and coal-to-carbon-based products. Operations are concentrated in the Appalachian basin, with active mines at Elk Creek, Berwind, Knox Creek, and Maben mining complexes.

Ramaco Resources's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Negative Revenue Trend: Examining Ramaco Resources's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -22.02% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Ramaco Resources's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -7.02%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Ramaco Resources's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -2.63%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Ramaco Resources's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -1.39%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.35.

To track all earnings releases for Ramaco Resources visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.