Exploring Ares Management's Earnings Expectations

Ares Management (NYSE:ARES) is preparing to release its quarterly earnings on Friday, 2025-08-01. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ares Management to report an earnings per share (EPS) of $1.10.

Investors in Ares Management are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

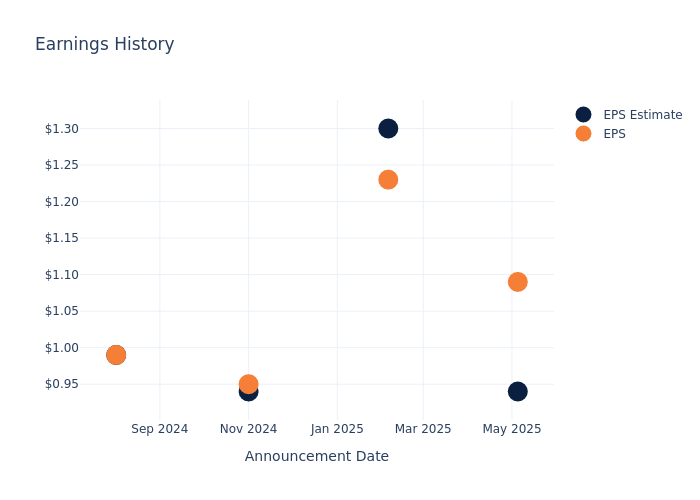

Performance in Previous Earnings

Last quarter the company beat EPS by $0.15, which was followed by a 0.7% drop in the share price the next day.

Here's a look at Ares Management's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.94 | 1.30 | 0.94 | 0.99 |

| EPS Actual | 1.09 | 1.23 | 0.95 | 0.99 |

| Price Change % | -1.0% | 1.0% | -3.0% | -7.000000000000001% |

Stock Performance

Shares of Ares Management were trading at $187.73 as of July 30. Over the last 52-week period, shares are up 34.81%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Ares Management

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ares Management.

Analysts have given Ares Management a total of 7 ratings, with the consensus rating being Outperform. The average one-year price target is $190.71, indicating a potential 1.59% upside.

Analyzing Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of T. Rowe Price Group, Franklin Resources and Blue Owl Capital, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for T. Rowe Price Group, with an average 1-year price target of $97.67, suggesting a potential 47.97% downside.

- Analysts currently favor an Neutral trajectory for Franklin Resources, with an average 1-year price target of $22.25, suggesting a potential 88.15% downside.

- Analysts currently favor an Outperform trajectory for Blue Owl Capital, with an average 1-year price target of $22.5, suggesting a potential 88.01% downside.

Analysis Summary for Peers

The peer analysis summary outlines pivotal metrics for T. Rowe Price Group, Franklin Resources and Blue Owl Capital, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ares Management | Outperform | 53.92% | $431.68M | 0.86% |

| T. Rowe Price Group | Neutral | 0.78% | $922M | 4.61% |

| Franklin Resources | Neutral | -1.92% | $1.67B | 1.11% |

| Blue Owl Capital | Outperform | 33.14% | $357.55M | 0.33% |

Key Takeaway:

Ares Management ranks at the top for Revenue Growth with 53.92%, outperforming its peers. It is at the bottom for Gross Profit at $431.68M. Ares Management is at the bottom for Return on Equity with 0.86%.

Delving into Ares Management's Background

Ares Management Corp is an asset management company. It offers investors investment-related advice and strategies for capital growth. The company's operating segments include Credit Group, Private Equity Group, Real Assets, Secondaries Group, and Others. Its Credit Group generates maximum revenue and manages credit strategies across the liquid and illiquid spectrum. Private Equity Group manages investment strategies categorized as corporate private equity, infrastructure and power, and special opportunities, Real Estate Group manages comprehensive equity and debt strategies across real estate & infrastructure investments. The Secondaries Group invests in secondary markets across a range of alternative asset class strategies, including private equity, real estate, infrastructure, & credit.

Breaking Down Ares Management's Financial Performance

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Ares Management's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 53.92%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Ares Management's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 2.01%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ares Management's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.86%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Ares Management's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.08%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a high debt-to-equity ratio of 4.46, Ares Management faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Ares Management visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.