Earnings Preview For Williams Companies

Williams Companies (NYSE:WMB) is preparing to release its quarterly earnings on Monday, 2025-08-04. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Williams Companies to report an earnings per share (EPS) of $0.49.

The market awaits Williams Companies's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

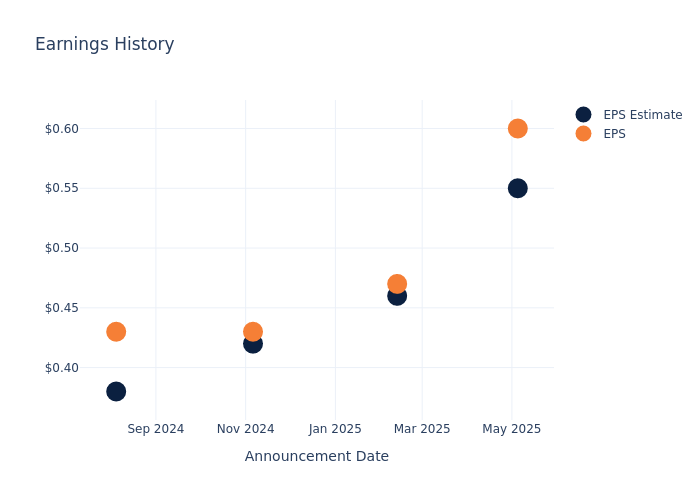

Past Earnings Performance

Last quarter the company beat EPS by $0.05, which was followed by a 2.44% drop in the share price the next day.

Here's a look at Williams Companies's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.55 | 0.46 | 0.42 | 0.38 |

| EPS Actual | 0.60 | 0.47 | 0.43 | 0.43 |

| Price Change % | -2.0% | 5.0% | 0.0% | 4.0% |

Williams Companies Share Price Analysis

Shares of Williams Companies were trading at $59.95 as of July 31. Over the last 52-week period, shares are up 43.72%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts' Take on Williams Companies

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Williams Companies.

Analysts have provided Williams Companies with 7 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $61.14, suggesting a potential 1.98% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Kinder Morgan, Energy Transfer and MPLX, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Kinder Morgan, with an average 1-year price target of $30.25, suggesting a potential 49.54% downside.

- Analysts currently favor an Outperform trajectory for Energy Transfer, with an average 1-year price target of $22.33, suggesting a potential 62.75% downside.

- Analysts currently favor an Outperform trajectory for MPLX, with an average 1-year price target of $52.5, suggesting a potential 12.43% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Kinder Morgan, Energy Transfer and MPLX, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Williams Companies | Outperform | 10.00% | $1.82B | 5.55% |

| Kinder Morgan | Neutral | 13.16% | $2.21B | 2.32% |

| Energy Transfer | Outperform | -2.82% | $4.08B | 3.56% |

| MPLX | Outperform | 10.87% | $1.27B | 8.15% |

Key Takeaway:

Williams Companies ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

All You Need to Know About Williams Companies

Williams Companies is a midstream energy company that owns and operates the large Transco and Northwest pipeline systems and associated natural gas gathering, processing, and storage assets. In August 2018, the firm acquired the remaining 26% ownership of its limited partner, Williams Partners.

Financial Milestones: Williams Companies's Journey

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Williams Companies's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 10.0%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Williams Companies's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 22.64%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Williams Companies's ROE stands out, surpassing industry averages. With an impressive ROE of 5.55%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.26%, the company showcases effective utilization of assets.

Debt Management: Williams Companies's debt-to-equity ratio is below the industry average at 2.2, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Williams Companies visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.