A Look at Axsome Therapeutics's Upcoming Earnings Report

Axsome Therapeutics (NASDAQ:AXSM) is preparing to release its quarterly earnings on Monday, 2025-08-04. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Axsome Therapeutics to report an earnings per share (EPS) of $-1.06.

Anticipation surrounds Axsome Therapeutics's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

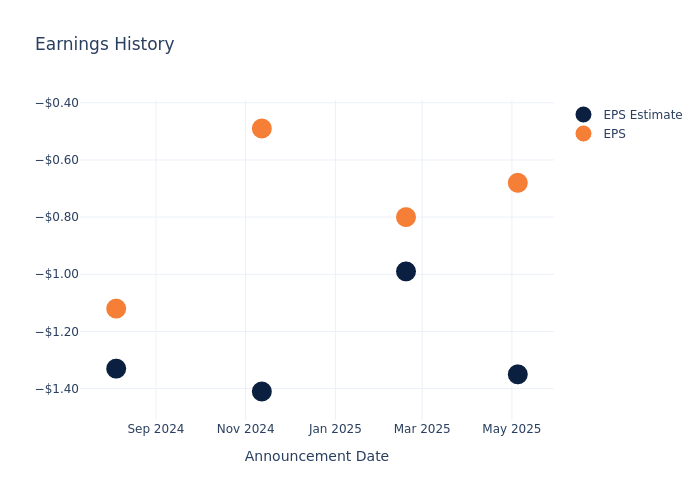

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.67, leading to a 3.72% drop in the share price the following trading session.

Here's a look at Axsome Therapeutics's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -1.35 | -0.99 | -1.41 | -1.33 |

| EPS Actual | -0.68 | -0.80 | -0.49 | -1.12 |

| Price Change % | -4.0% | -1.0% | -2.0% | 3.0% |

Stock Performance

Shares of Axsome Therapeutics were trading at $101.38 as of July 31. Over the last 52-week period, shares are up 23.66%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Axsome Therapeutics

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Axsome Therapeutics.

Analysts have provided Axsome Therapeutics with 9 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $175.33, suggesting a potential 72.94% upside.

Comparing Ratings Among Industry Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Elanco Animal Health, Jazz Pharmaceuticals and Corcept Therapeutics, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Elanco Animal Health, with an average 1-year price target of $16.8, suggesting a potential 83.43% downside.

- Analysts currently favor an Outperform trajectory for Jazz Pharmaceuticals, with an average 1-year price target of $176.12, suggesting a potential 73.72% upside.

- Analysts currently favor an Buy trajectory for Corcept Therapeutics, with an average 1-year price target of $134.33, suggesting a potential 32.5% upside.

Overview of Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Elanco Animal Health, Jazz Pharmaceuticals and Corcept Therapeutics, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Axsome Therapeutics | Outperform | 61.95% | $111.67M | -107.81% |

| Elanco Animal Health | Buy | -1.00% | $684M | 1.08% |

| Jazz Pharmaceuticals | Outperform | -0.46% | $793.22M | -2.24% |

| Corcept Therapeutics | Buy | 7.09% | $154.81M | 2.98% |

Key Takeaway:

Axsome Therapeutics ranks at the top for Revenue Growth and Gross Profit, while it ranks at the bottom for Return on Equity among its peers.

Discovering Axsome Therapeutics: A Closer Look

Axsome Therapeutics Inc is a clinical-stage biopharmaceutical company. It is engaged in developing novel therapies for the management of the central nervous system, or CNS, disorders for which there are limited treatment options. Its pipeline products includes AXS-05, AXS-07, AXS-12, and AXS-14. It manages its business as one operating segment and reporting unit, which is the business of developing and delivering novel therapies for the management of CNS disorders.

Axsome Therapeutics's Economic Impact: An Analysis

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Axsome Therapeutics's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 61.95%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Axsome Therapeutics's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -48.91%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -107.81%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Axsome Therapeutics's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -10.2%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Axsome Therapeutics's debt-to-equity ratio is notably higher than the industry average. With a ratio of 3.97, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Axsome Therapeutics visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.