A Peek at Adtran's Future Earnings

Adtran (NASDAQ:ADTN) is preparing to release its quarterly earnings on Monday, 2025-08-04. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Adtran to report an earnings per share (EPS) of $-0.02.

Investors in Adtran are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

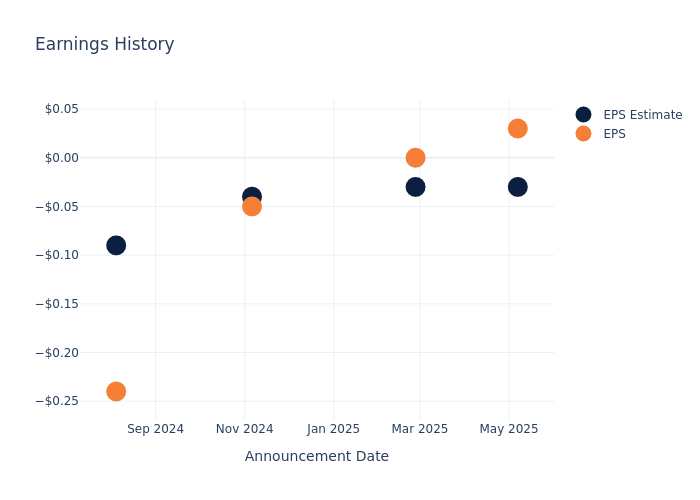

Past Earnings Performance

In the previous earnings release, the company beat EPS by $0.06, leading to a 3.02% drop in the share price the following trading session.

Here's a look at Adtran's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.03 | -0.03 | -0.04 | -0.09 |

| EPS Actual | 0.03 | 0 | -0.05 | -0.24 |

| Price Change % | -3.0% | -0.0% | 19.0% | -19.0% |

Analyst Observations about Adtran

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Adtran.

Analysts have provided Adtran with 1 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $12.0, suggesting a potential 29.17% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of Ribbon Communications, Harmonic and Digi Intl, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Ribbon Communications, with an average 1-year price target of $6.0, suggesting a potential 35.41% downside.

- Analysts currently favor an Buy trajectory for Harmonic, with an average 1-year price target of $10.5, suggesting a potential 13.02% upside.

- Analysts currently favor an Neutral trajectory for Digi Intl, with an average 1-year price target of $30.0, suggesting a potential 222.93% upside.

Summary of Peers Analysis

The peer analysis summary outlines pivotal metrics for Ribbon Communications, Harmonic and Digi Intl, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Adtran Holdings | Buy | 9.54% | $95.18M | -5.74% |

| Ribbon Communications | Buy | 14.52% | $109.31M | -2.95% |

| Harmonic | Buy | 3.67% | $78.57M | 0.64% |

| Digi Intl | Neutral | -2.97% | $64.93M | 1.76% |

Key Takeaway:

Adtran ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. For Return on Equity, Adtran is at the bottom compared to its peers.

Get to Know Adtran Better

Adtran Holdings Inc is a provider of networking and communications platforms, software, and services focused on the broadband access market. It operates under two reportable segments: Network Solutions, which includes hardware and software products that enable a digital future that supports the company's Subscriber, Access & Aggregation, and Optical Networking Solutions; and Services & Support Segment which includes network design, implementation, maintenance and cloud-hosted services supporting the company's Subscriber, Access & Aggregation, and Optical Networking Solutions.

Adtran's Economic Impact: An Analysis

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Adtran's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 9.54%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -4.55%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Adtran's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -5.74%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Adtran's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.9%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Adtran's debt-to-equity ratio is below the industry average at 0.84, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Adtran visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.