An Overview of BRC's Earnings

BRC (NYSE:BRCC) is set to give its latest quarterly earnings report on Monday, 2025-08-04. Here's what investors need to know before the announcement.

Analysts estimate that BRC will report an earnings per share (EPS) of $-0.03.

Anticipation surrounds BRC's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

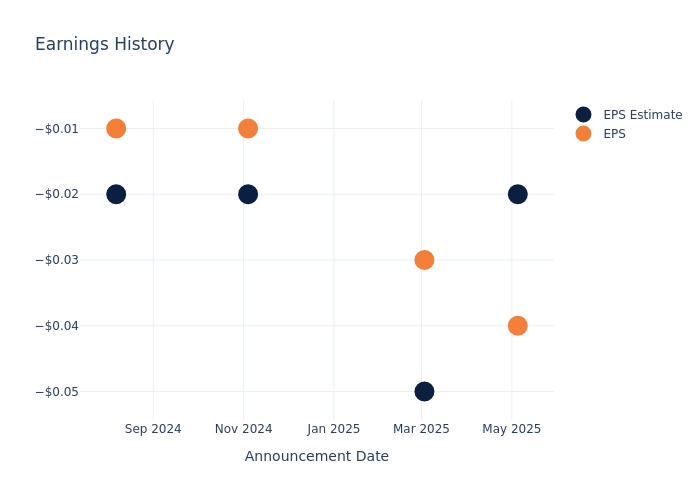

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.02, leading to a 25.74% drop in the share price the following trading session.

Here's a look at BRC's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.02 | -0.05 | -0.02 | -0.02 |

| EPS Actual | -0.04 | -0.03 | -0.01 | -0.01 |

| Price Change % | -26.0% | -16.0% | 4.0% | -38.0% |

Market Performance of BRC's Stock

Shares of BRC were trading at $1.7 as of July 31. Over the last 52-week period, shares are down 67.65%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Observations about BRC

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding BRC.

Analysts have given BRC a total of 3 ratings, with the consensus rating being Outperform. The average one-year price target is $4.0, indicating a potential 135.29% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Hain Celestial Group, Mama's Creations and Laird Superfood, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Hain Celestial Group, with an average 1-year price target of $2.63, suggesting a potential 54.71% upside.

- Analysts currently favor an Buy trajectory for Mama's Creations, with an average 1-year price target of $10.0, suggesting a potential 488.24% upside.

- Analysts currently favor an Buy trajectory for Laird Superfood, with an average 1-year price target of $12.0, suggesting a potential 605.88% upside.

Overview of Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for Hain Celestial Group, Mama's Creations and Laird Superfood, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| BRC | Outperform | -8.56% | $32.47M | -23.72% |

| Hain Celestial Group | Neutral | -10.95% | $84.65M | -17.93% |

| Mama's Creations | Buy | 18.15% | $9.18M | 4.82% |

| Laird Superfood | Buy | 17.61% | $4.88M | -1.18% |

Key Takeaway:

BRC ranks at the bottom for Revenue Growth and Gross Profit among its peers. However, it has the highest Return on Equity. Overall, BRC's performance is mixed compared to its peers, with strengths in profitability but weaknesses in revenue growth.

All You Need to Know About BRC

BRC Inc is a veteran-controlled company that serves premium coffee, content, and merchandise to active military, veterans, and first responders. It is committed to producing great coffee that consumers love, and high-quality merchandise that enables its community to showcase its brand. Its omnichannel distribution has three components: Direct to Consumer channel includes its e-commerce business, through which consumers order products online and products are shipped to them, Its wholesale channel includes products sold to an intermediary such as convenience, grocery, drug, and mass merchandise stores, who in turn sell those products to consumers, and Outpost channel includes revenue from its Company-operated and franchised Black Rifle Coffee retail coffee shop locations.

Unraveling the Financial Story of BRC

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: BRC's revenue growth over 3 months faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -8.56%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: BRC's net margin excels beyond industry benchmarks, reaching -3.21%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): BRC's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -23.72%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): BRC's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.28% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 8.92, caution is advised due to increased financial risk.

To track all earnings releases for BRC visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.