A Preview Of Klaviyo's Earnings

Klaviyo (NYSE:KVYO) is preparing to release its quarterly earnings on Tuesday, 2025-08-05. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Klaviyo to report an earnings per share (EPS) of $0.08.

Klaviyo bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

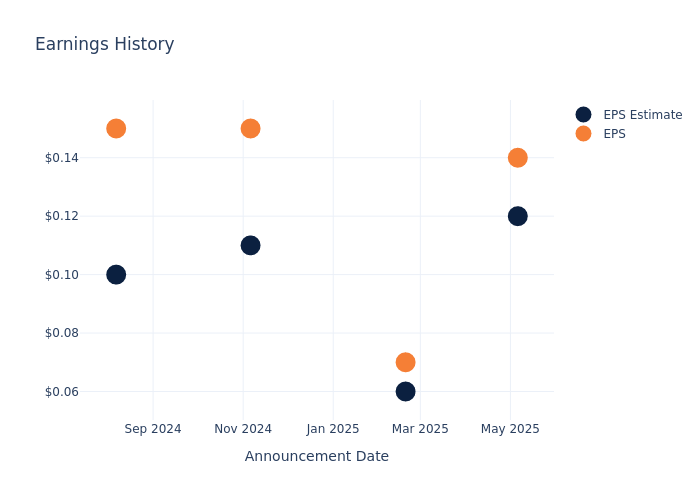

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.02, leading to a 6.39% increase in the share price on the subsequent day.

Here's a look at Klaviyo's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.12 | 0.06 | 0.11 | 0.10 |

| EPS Actual | 0.14 | 0.07 | 0.15 | 0.15 |

| Price Change % | 6.0% | -6.0% | -16.0% | 33.0% |

Stock Performance

Shares of Klaviyo were trading at $29.72 as of August 01. Over the last 52-week period, shares are up 36.27%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Klaviyo

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Klaviyo.

The consensus rating for Klaviyo is Buy, derived from 8 analyst ratings. An average one-year price target of $42.38 implies a potential 42.6% upside.

Peer Ratings Overview

The analysis below examines the analyst ratings and average 1-year price targets of Procore Technologies, NICE and Pegasystems, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Procore Technologies, with an average 1-year price target of $81.0, suggesting a potential 172.54% upside.

- Analysts currently favor an Outperform trajectory for NICE, with an average 1-year price target of $210.62, suggesting a potential 608.68% upside.

- Analysts currently favor an Buy trajectory for Pegasystems, with an average 1-year price target of $80.3, suggesting a potential 170.19% upside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for Procore Technologies, NICE and Pegasystems are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Klaviyo | Buy | 33.26% | $212.13M | -1.34% |

| Procore Technologies | Neutral | 4.28% | $245.71M | -1.76% |

| NICE | Outperform | 6.20% | $468.11M | 3.65% |

| Pegasystems | Buy | 9.50% | $274.94M | 4.87% |

Key Takeaway:

Klaviyo ranks at the bottom for Revenue Growth and Gross Profit, with the lowest percentage growth and profit among its peers. However, it has the highest Return on Equity, indicating strong performance in generating profit relative to shareholder equity. Overall, Klaviyo's performance is mixed compared to its peers, excelling in profitability but lagging in revenue growth and gross profit.

All You Need to Know About Klaviyo

Klaviyo Inc is a technology company that provides a software-as-a-service (SaaS) platform to enable its customers to send the right messages at the right time across email, short message service, and push notifications, more accurately measure and predict performance, and deploy specific actions and campaigns. The platform combines proprietary data and application layers into one solution with machine learning and artificial intelligence capabilities. It is focused on marketing automation within eCommerce as its first application use case. It generates revenue through the sale of subscriptions to its customers for the use of its platform. Geographically, the company generates the majority of its revenue from the Americas, followed by EMEA and APAC.

Klaviyo: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Positive Revenue Trend: Examining Klaviyo's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 33.26% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Klaviyo's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -5.03%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Klaviyo's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -1.34%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Klaviyo's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -1.08%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Klaviyo's debt-to-equity ratio is below the industry average. With a ratio of 0.1, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Klaviyo visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.