A Preview Of Douglas Emmett's Earnings

Douglas Emmett (NYSE:DEI) will release its quarterly earnings report on Tuesday, 2025-08-05. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Douglas Emmett to report an earnings per share (EPS) of $0.11.

The announcement from Douglas Emmett is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

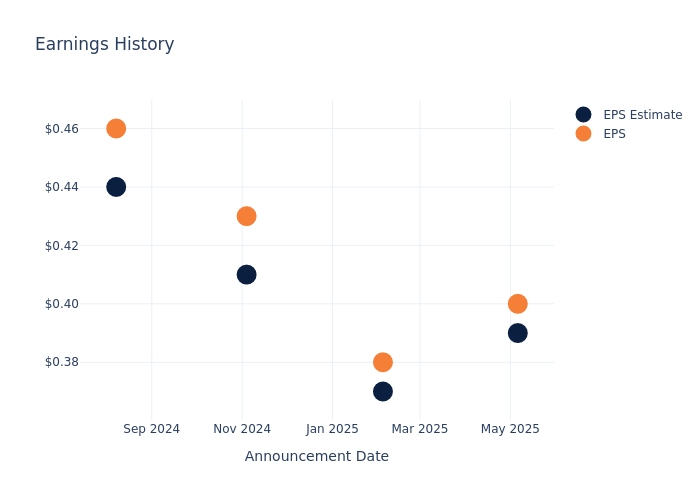

Overview of Past Earnings

The company's EPS beat by $0.01 in the last quarter, leading to a 3.42% increase in the share price on the following day.

Here's a look at Douglas Emmett's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.39 | 0.37 | 0.41 | 0.44 |

| EPS Actual | 0.40 | 0.38 | 0.43 | 0.46 |

| Price Change % | 3.0% | -1.0% | 3.0% | -3.0% |

Stock Performance

Shares of Douglas Emmett were trading at $14.91 as of August 01. Over the last 52-week period, shares are down 1.87%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Insights on Douglas Emmett

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Douglas Emmett.

The consensus rating for Douglas Emmett is Outperform, based on 4 analyst ratings. With an average one-year price target of $17.5, there's a potential 17.37% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of COPT Defense Props, Highwoods Props and Paramount Group, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for COPT Defense Props, with an average 1-year price target of $30.0, suggesting a potential 101.21% upside.

- Analysts currently favor an Neutral trajectory for Highwoods Props, with an average 1-year price target of $30.5, suggesting a potential 104.56% upside.

- Analysts currently favor an Outperform trajectory for Paramount Group, with an average 1-year price target of $6.17, suggesting a potential 58.62% downside.

Peer Metrics Summary

The peer analysis summary offers a detailed examination of key metrics for COPT Defense Props, Highwoods Props and Paramount Group, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Douglas Emmett | Outperform | 2.68% | $161.93M | 1.92% |

| COPT Defense Props | Outperform | 1.37% | $71.55M | 2.57% |

| Highwoods Props | Neutral | -2.02% | $136.94M | 0.77% |

| Paramount Group | Outperform | -5.53% | $102.16M | -0.65% |

Key Takeaway:

Douglas Emmett is at the top for Revenue Growth and Gross Profit, outperforming its peers. It is in the middle for Return on Equity.

Delving into Douglas Emmett's Background

Douglas Emmett Inc is an integrated, self-administered, and self-managed REIT. It is an owner and operator of office and multifamily properties located in coastal submarkets in Los Angeles and Honolulu. The group focuses on owning, acquiring, developing, and managing a substantial market share of office properties and multifamily communities in neighborhoods with supply constraints, high-end executive housing, and key lifestyle amenities. Its properties are located in the Beverly Hills, Brentwood, Burbank, Century City, Olympic Corridor, Santa Monica, Sherman Oaks/Encino, Warner Center/Woodland Hills and Westwood submarkets of Los Angeles County, California, and in Honolulu, Hawaii. It has two business segments, the office segment and the multifamily segment.

Understanding the Numbers: Douglas Emmett's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3 months period, Douglas Emmett showcased positive performance, achieving a revenue growth rate of 2.68% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 15.65%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Douglas Emmett's ROE stands out, surpassing industry averages. With an impressive ROE of 1.92%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Douglas Emmett's ROA stands out, surpassing industry averages. With an impressive ROA of 0.41%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Douglas Emmett's debt-to-equity ratio surpasses industry norms, standing at 2.76. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Douglas Emmett visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.