Earnings Outlook For Revolve Gr

Revolve Gr (NYSE:RVLV) will release its quarterly earnings report on Tuesday, 2025-08-05. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Revolve Gr to report an earnings per share (EPS) of $0.13.

Anticipation surrounds Revolve Gr's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

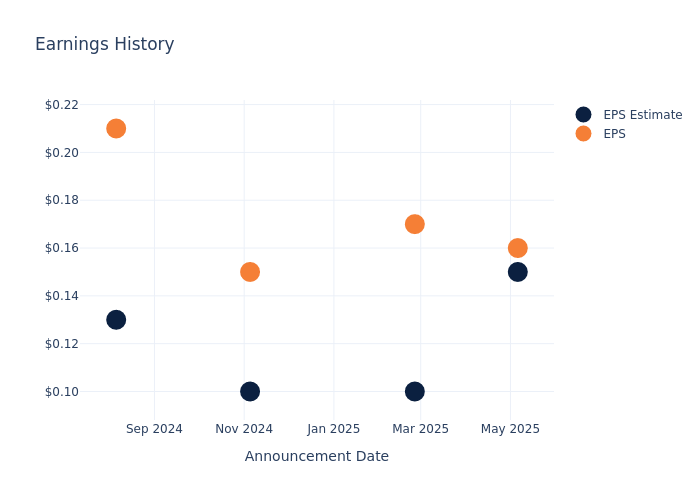

Earnings History Snapshot

Last quarter the company beat EPS by $0.01, which was followed by a 9.87% drop in the share price the next day.

Here's a look at Revolve Gr's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.15 | 0.10 | 0.10 | 0.13 |

| EPS Actual | 0.16 | 0.17 | 0.15 | 0.21 |

| Price Change % | -10.0% | -5.0% | 28.000000000000004% | 33.0% |

Performance of Revolve Gr Shares

Shares of Revolve Gr were trading at $20.11 as of August 01. Over the last 52-week period, shares are up 16.45%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on Revolve Gr

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Revolve Gr.

The consensus rating for Revolve Gr is Neutral, based on 8 analyst ratings. With an average one-year price target of $22.75, there's a potential 13.13% upside.

Peer Ratings Overview

This comparison focuses on the analyst ratings and average 1-year price targets of and Victoria's Secret, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Victoria's Secret, with an average 1-year price target of $22.8, suggesting a potential 13.38% upside.

Peer Analysis Summary

The peer analysis summary presents essential metrics for and Victoria's Secret, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Revolve Gr | Neutral | 9.66% | $154.29M | 2.65% |

| Victoria's Secret | Neutral | -0.44% | $474M | -0.31% |

Key Takeaway:

Revolve Gr ranks higher than its peer in terms of Revenue Growth and Gross Profit, indicating stronger performance in these areas. However, its Return on Equity is lower compared to its peer. Overall, Revolve Gr is positioned favorably among its peers based on the provided metrics.

Delving into Revolve Gr's Background

Revolve Group Inc is an emerging e-commerce retailer, selling women's dresses, handbags, shoes, beauty products, and incidentals across its marketplace properties, Revolve and FWRD. The platform is built to suit the "next-generation customer," emphasizing mobile commerce, influencer marketing, and occupying an aspirational but attainable luxury niche. With $1.1 billion in 2024 net sales, the firm sits just outside the top 30 apparel retailers (by sales) in the U.S, but has consistently generated robust top-line growth as the industry continues to favor digital channels. Revolve generates approximately 18% of sales from private-label offerings, while focusing on building an inventory of distinctive products from emerging fashion brands with less than $10 million in annual sales.

Breaking Down Revolve Gr's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Revolve Gr displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 9.66%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Revolve Gr's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.98% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Revolve Gr's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.65% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Revolve Gr's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.71%, the company showcases efficient use of assets and strong financial health.

Debt Management: Revolve Gr's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.1.

To track all earnings releases for Revolve Gr visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.