What to Expect from Rigel Pharmaceuticals's Earnings

Rigel Pharmaceuticals (NASDAQ:RIGL) will release its quarterly earnings report on Tuesday, 2025-08-05. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Rigel Pharmaceuticals to report an earnings per share (EPS) of $1.41.

Rigel Pharmaceuticals bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

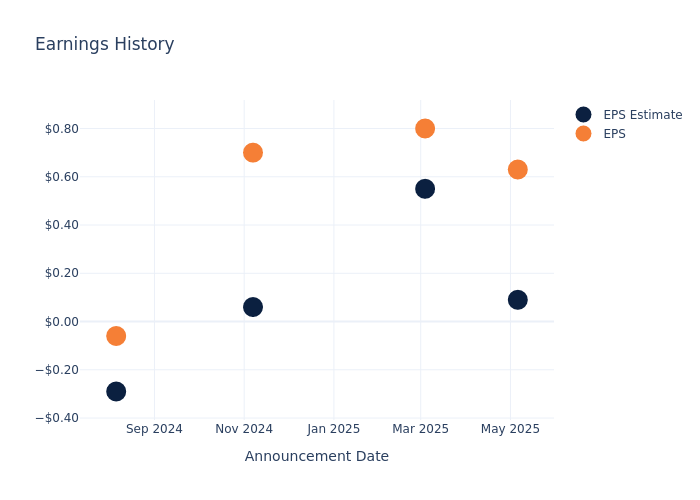

Earnings History Snapshot

During the last quarter, the company reported an EPS beat by $0.54, leading to a 1.15% increase in the share price on the subsequent day.

Here's a look at Rigel Pharmaceuticals's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.09 | 0.55 | 0.06 | -0.29 |

| EPS Actual | 0.63 | 0.80 | 0.70 | -0.06 |

| Price Change % | 1.0% | -8.0% | 43.0% | 6.0% |

Rigel Pharmaceuticals Share Price Analysis

Shares of Rigel Pharmaceuticals were trading at $21.91 as of August 01. Over the last 52-week period, shares are up 140.84%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Rigel Pharmaceuticals

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Rigel Pharmaceuticals.

The consensus rating for Rigel Pharmaceuticals is Neutral, based on 1 analyst ratings. With an average one-year price target of $23.0, there's a potential 4.97% upside.

Analyzing Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of and Rigel Pharmaceuticals, three prominent industry players, providing insights into their relative performance expectations and market positioning.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for and Rigel Pharmaceuticals are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Rigel Pharmaceuticals | Neutral | 80.58% | $48.92M | 104.74% |

Key Takeaway:

Rigel Pharmaceuticals ranks at the top among its peers in terms of revenue growth, with a growth rate of 80.58%. It also leads in gross profit, standing at $48.92M. Additionally, the company excels in return on equity, achieving a rate of 104.74%.

About Rigel Pharmaceuticals

Rigel Pharmaceuticals Inc develops small-molecule drugs for autoimmune, cancer-related, and viral diseases. The firm's primary drug is an oral rheumatoid arthritis drug candidate that has been licensed to AstraZeneca. Astra has taken overall responsibility for developing and marketing the drug and will pay Rigel royalties and milestone payments. Its pipeline product includes TAVALISSE (fostamatinib disodium hexahydrate) tablets, the only oral spleen tyrosine kinase (SYK) inhibitor, Fostamatinib, R289, R552, R835, DS-3032, THF-beta Inhibitors, and AZD0449- Inhaled JAK Inhibitor.

Financial Insights: Rigel Pharmaceuticals

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Rigel Pharmaceuticals's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 80.58%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Rigel Pharmaceuticals's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 21.46%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 104.74%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Rigel Pharmaceuticals's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 6.73%, the company showcases efficient use of assets and strong financial health.

Debt Management: Rigel Pharmaceuticals's debt-to-equity ratio stands notably higher than the industry average, reaching 3.29. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Rigel Pharmaceuticals visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.