A Look at Chemours's Upcoming Earnings Report

Chemours (NYSE:CC) is set to give its latest quarterly earnings report on Tuesday, 2025-08-05. Here's what investors need to know before the announcement.

Analysts estimate that Chemours will report an earnings per share (EPS) of $0.46.

Anticipation surrounds Chemours's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

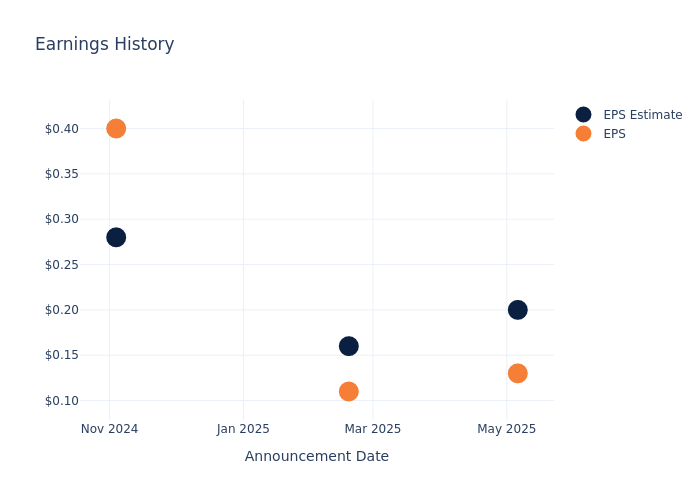

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.07, leading to a 9.92% drop in the share price on the subsequent day.

Here's a look at Chemours's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.20 | 0.16 | 0.28 | 0.57 |

| EPS Actual | 0.13 | 0.11 | 0.40 | 0.38 |

| Price Change % | -10.0% | -2.0% | -3.0% | -12.0% |

Stock Performance

Shares of Chemours were trading at $11.5 as of August 01. Over the last 52-week period, shares are down 34.62%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Insights Shared by Analysts on Chemours

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Chemours.

The consensus rating for Chemours is Neutral, derived from 7 analyst ratings. An average one-year price target of $14.86 implies a potential 29.22% upside.

Comparing Ratings with Competitors

The below comparison of the analyst ratings and average 1-year price targets of Minerals Technologies, Huntsman and Ingevity, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Minerals Technologies, with an average 1-year price target of $84.0, suggesting a potential 630.43% upside.

- Analysts currently favor an Neutral trajectory for Huntsman, with an average 1-year price target of $11.07, suggesting a potential 3.74% downside.

- Analysts currently favor an Neutral trajectory for Ingevity, with an average 1-year price target of $43.0, suggesting a potential 273.91% upside.

Peer Analysis Summary

The peer analysis summary presents essential metrics for Minerals Technologies, Huntsman and Ingevity, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Chemours | Neutral | 0.44% | $236M | -0.68% |

| Minerals Technologies | Buy | -2.27% | $136.90M | 2.79% |

| Huntsman | Neutral | 3.40% | $201M | -5.47% |

| Ingevity | Neutral | -16.50% | $113.40M | 9.54% |

Key Takeaway:

Chemours ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, Chemours is at the bottom compared to its peers.

About Chemours

The Chemours Co is a provider of chemicals. It delivers customized solutions with a wide range of industrial and specialty chemicals products for various markets including coatings, plastics, refrigeration, air conditioning, etc. The company's operating segments include Titanium Technologies, Thermal & Specialized Solutions, and Advanced Performance Materials. It generates maximum revenue from the Titanium Technologies segment. The Titanium Technologies segment is a producer of TiO2 pigment, a premium white pigment used to deliver whiteness, brightness, opacity, durability, efficiency, and protection across a variety of applications. Geographically, the company derives a majority of its revenue from North America.

Unraveling the Financial Story of Chemours

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Chemours showcased positive performance, achieving a revenue growth rate of 0.44% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Materials sector.

Net Margin: Chemours's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.29% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Chemours's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.68% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Chemours's ROA stands out, surpassing industry averages. With an impressive ROA of -0.05%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Chemours's debt-to-equity ratio surpasses industry norms, standing at 7.57. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Chemours visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.