Duolingo's Earnings Outlook

Duolingo (NASDAQ:DUOL) is gearing up to announce its quarterly earnings on Wednesday, 2025-08-06. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Duolingo will report an earnings per share (EPS) of $0.99.

The market awaits Duolingo's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

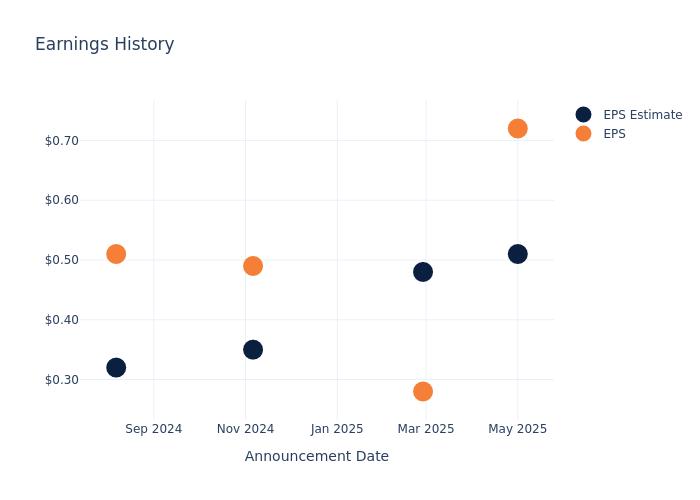

Past Earnings Performance

The company's EPS beat by $0.21 in the last quarter, leading to a 21.61% increase in the share price on the following day.

Here's a look at Duolingo's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.51 | 0.48 | 0.35 | 0.32 |

| EPS Actual | 0.72 | 0.28 | 0.49 | 0.51 |

| Price Change % | 22.0% | -17.0% | -1.0% | 11.0% |

Market Performance of Duolingo's Stock

Shares of Duolingo were trading at $352.36 as of August 04. Over the last 52-week period, shares are up 119.66%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Duolingo

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Duolingo.

Analysts have provided Duolingo with 7 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $526.43, suggesting a potential 49.4% upside.

Comparing Ratings with Peers

The below comparison of the analyst ratings and average 1-year price targets of and Bright Horizons Family, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Underperform trajectory for Bright Horizons Family, with an average 1-year price target of $113.0, suggesting a potential 67.93% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for and Bright Horizons Family, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Duolingo | Outperform | 37.71% | $164.10M | 4.09% |

| Bright Horizons Family | Underperform | 9.92% | $155.74M | 4.02% |

Key Takeaway:

Duolingo outperforms its peer in revenue growth, with a higher percentage. It also leads in gross profit. However, its return on equity is lower compared to its peer.

Get to Know Duolingo Better

Duolingo Inc is a technology company that develops a mobile learning platform to learn languages and is the top-grossing app in the Education category on both Google Play and the Apple App Store. Its products are powered by sophisticated data analytics and artificial intelligence and delivered with class art, animation, and design to make it easier for learners to stay motivated master new material, and achieve their learning goals. Its solutions include the Duolingo Language Learning App, Super Duolingo, Duolingo English Test: AI-Driven Language Assessment, Duolingo For Schools, Duolingo ABC, and Duolingo Math. It has four predominant sources of revenue; time-based subscriptions, in-app advertising placement by third parties, and the Duolingo English Test, and In-App Purchases.

Duolingo's Financial Performance

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Positive Revenue Trend: Examining Duolingo's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 37.71% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Duolingo's net margin is impressive, surpassing industry averages. With a net margin of 15.23%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Duolingo's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 4.09%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Duolingo's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.4%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Duolingo's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.06.

To track all earnings releases for Duolingo visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.