Examining the Future: Niagen Bioscience's Earnings Outlook

Niagen Bioscience (NASDAQ:NAGE) is preparing to release its quarterly earnings on Wednesday, 2025-08-06. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Niagen Bioscience to report an earnings per share (EPS) of $0.01.

Anticipation surrounds Niagen Bioscience's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

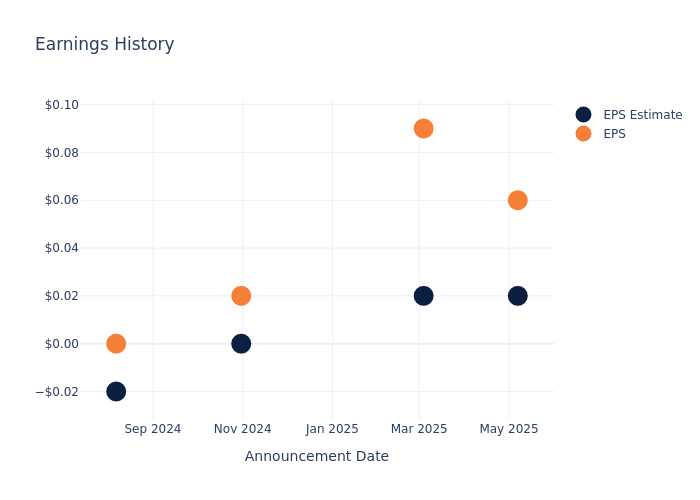

Past Earnings Performance

The company's EPS beat by $0.04 in the last quarter, leading to a 9.35% increase in the share price on the following day.

Here's a look at Niagen Bioscience's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.02 | 0.02 | 0 | -0.02 |

| EPS Actual | 0.06 | 0.09 | 0.02 | 0 |

| Price Change % | 9.0% | 53.0% | 68.0% | 10.0% |

Performance of Niagen Bioscience Shares

Shares of Niagen Bioscience were trading at $9.64 as of August 04. Over the last 52-week period, shares are up 250.42%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Opinions on Niagen Bioscience

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Niagen Bioscience.

With 3 analyst ratings, Niagen Bioscience has a consensus rating of Buy. The average one-year price target is $17.33, indicating a potential 79.77% upside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Fortrea Holdings, BioLife Solutions and Cytek Biosciences, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Fortrea Holdings, with an average 1-year price target of $6.5, suggesting a potential 32.57% downside.

- Analysts currently favor an Buy trajectory for BioLife Solutions, with an average 1-year price target of $30.0, suggesting a potential 211.2% upside.

- Analysts currently favor an Neutral trajectory for Cytek Biosciences, with an average 1-year price target of $5.0, suggesting a potential 48.13% downside.

Peer Analysis Summary

The peer analysis summary presents essential metrics for Fortrea Holdings, BioLife Solutions and Cytek Biosciences, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Niagen Bioscience | Buy | 37.59% | $19.33M | 9.98% |

| Fortrea Holdings | Neutral | -1.63% | $116.50M | -50.68% |

| BioLife Solutions | Buy | 29.88% | $15.79M | -0.13% |

| Cytek Biosciences | Neutral | -7.59% | $20.16M | -2.94% |

Key Takeaway:

Niagen Bioscience ranks highest in Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is also in the middle.

Get to Know Niagen Bioscience Better

Niagen Bioscience Inc is the leader in NAD+ (nicotinamide adenine dinucleotide) science and healthy-aging research. It is dedicated to advancing healthspan through precision science and innovative NAD+-boosting solutions. It is is clinically proven to increase NAD+ levels efficiently and effectively, and is the key ingredient powering our suite of Niagen brands.

Financial Insights: Niagen Bioscience

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Niagen Bioscience displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 37.59%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 16.61%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.98%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Niagen Bioscience's ROA excels beyond industry benchmarks, reaching 6.77%. This signifies efficient management of assets and strong financial health.

Debt Management: Niagen Bioscience's debt-to-equity ratio is below the industry average. With a ratio of 0.06, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Niagen Bioscience visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.