Uncovering Potential: EOG Resources's Earnings Preview

EOG Resources (NYSE:EOG) will release its quarterly earnings report on Thursday, 2025-08-07. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate EOG Resources to report an earnings per share (EPS) of $2.22.

EOG Resources bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

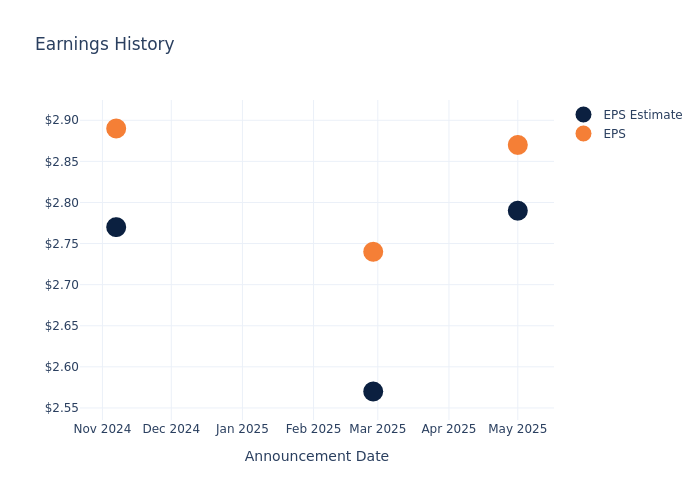

Earnings History Snapshot

The company's EPS beat by $0.08 in the last quarter, leading to a 0.73% drop in the share price on the following day.

Here's a look at EOG Resources's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.79 | 2.57 | 2.77 | 2.99 |

| EPS Actual | 2.87 | 2.74 | 2.89 | 3.16 |

| Price Change % | -1.0% | -3.0% | 6.0% | -0.0% |

Stock Performance

Shares of EOG Resources were trading at $117.78 as of August 05. Over the last 52-week period, shares are down 5.81%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Observations about EOG Resources

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding EOG Resources.

Analysts have given EOG Resources a total of 17 ratings, with the consensus rating being Neutral. The average one-year price target is $142.94, indicating a potential 21.36% upside.

Comparing Ratings with Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Diamondback Energy, Venture Global and EQT, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Diamondback Energy, with an average 1-year price target of $198.0, suggesting a potential 68.11% upside.

- Analysts currently favor an Buy trajectory for Venture Global, with an average 1-year price target of $17.0, suggesting a potential 85.57% downside.

- Analysts currently favor an Neutral trajectory for EQT, with an average 1-year price target of $62.36, suggesting a potential 47.05% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Diamondback Energy, Venture Global and EQT, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| EOG Resources | Neutral | 0.14% | $3.99B | 4.97% |

| Diamondback Energy | Outperform | -9.43% | $1.81B | 1.81% |

| Venture Global | Buy | 104.67% | $1.62B | 10.18% |

| EQT | Neutral | 106.22% | $733.65M | 3.72% |

Key Takeaway:

EOG Resources ranks at the top for Gross Profit and Return on Equity among its peers. In terms of Revenue Growth, it is in the middle.

Discovering EOG Resources: A Closer Look

EOG Resources is an oil and gas producer with acreage in several US shale plays, primarily in the Permian Basin and the Eagle Ford. At the end of 2024, it reported net proven reserves of 4.7 billion barrels of oil equivalent. Net production averaged roughly 1,062 thousand barrels of oil equivalent per day in 2024 at a ratio of 69% oil and natural gas liquids and 31% natural gas.

A Deep Dive into EOG Resources's Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: EOG Resources displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 0.14%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Energy sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 25.04%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): EOG Resources's ROE excels beyond industry benchmarks, reaching 4.97%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): EOG Resources's ROA stands out, surpassing industry averages. With an impressive ROA of 3.11%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.17.

To track all earnings releases for EOG Resources visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.