Earnings Outlook For MP Materials

MP Materials (NYSE:MP) is set to give its latest quarterly earnings report on Thursday, 2025-08-07. Here's what investors need to know before the announcement.

Analysts estimate that MP Materials will report an earnings per share (EPS) of $-0.20.

Investors in MP Materials are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

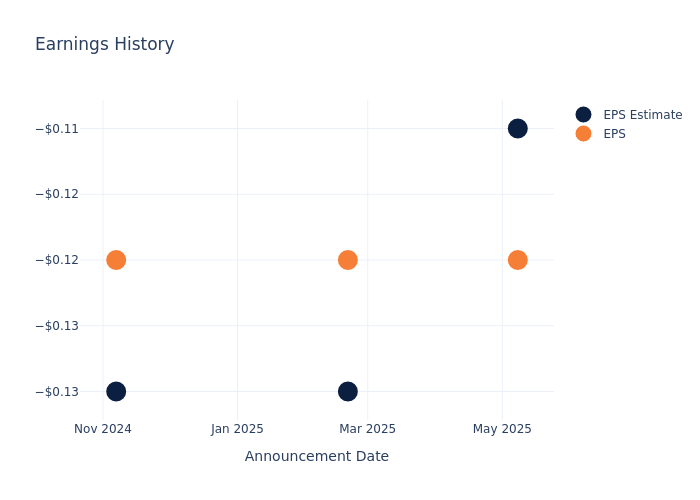

Earnings History Snapshot

The company's EPS missed by $0.01 in the last quarter, leading to a 7.97% drop in the share price on the following day.

Here's a look at MP Materials's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.11 | -0.13 | -0.13 | -0.08 |

| EPS Actual | -0.12 | -0.12 | -0.12 | -0.17 |

| Price Change % | -8.0% | 5.0% | -2.0% | -12.0% |

Market Performance of MP Materials's Stock

Shares of MP Materials were trading at $68.39 as of August 05. Over the last 52-week period, shares are up 521.06%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Insights on MP Materials

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding MP Materials.

MP Materials has received a total of 10 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $50.9, the consensus suggests a potential 25.57% downside.

Analyzing Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Materion, Ivanhoe Electric and Compass Minerals Intl, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Materion, with an average 1-year price target of $112.0, suggesting a potential 63.77% upside.

- Analysts currently favor an Outperform trajectory for Ivanhoe Electric, with an average 1-year price target of $14.0, suggesting a potential 79.53% downside.

- Analysts currently favor an Buy trajectory for Compass Minerals Intl, with an average 1-year price target of $21.0, suggesting a potential 69.29% downside.

Summary of Peers Analysis

The peer analysis summary outlines pivotal metrics for Materion, Ivanhoe Electric and Compass Minerals Intl, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| MP Materials | Neutral | 24.91% | $-9.40M | -2.17% |

| Materion | Outperform | 1.36% | $82.66M | 2.80% |

| Ivanhoe Electric | Outperform | 104.17% | $442K | -10.60% |

| Compass Minerals Intl | Buy | 35.88% | $76.80M | -12.81% |

Key Takeaway:

MP Materials ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it ranks in the middle for Return on Equity. Overall, MP Materials is positioned lower compared to its peers in terms of financial performance metrics.

Discovering MP Materials: A Closer Look

MP Materials Corp is the producer of rare earth materials in the Western Hemisphere. The company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility, the only rare earth mining and processing site of scale in North America. The company is also developing a rare earth metal, alloy, and magnet manufacturing facility in Fort Worth, Texas. The company's operations are organized into two reportable segments: Materials and Magnetics.

MP Materials: A Financial Overview

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, MP Materials showcased positive performance, achieving a revenue growth rate of 24.91% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: MP Materials's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -37.24% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): MP Materials's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.17% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.96%, the company showcases effective utilization of assets.

Debt Management: MP Materials's debt-to-equity ratio surpasses industry norms, standing at 0.88. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for MP Materials visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.