A Look Ahead: Lamar Advertising's Earnings Forecast

Lamar Advertising (NASDAQ:LAMR) is set to give its latest quarterly earnings report on Friday, 2025-08-08. Here's what investors need to know before the announcement.

Analysts estimate that Lamar Advertising will report an earnings per share (EPS) of $1.71.

The market awaits Lamar Advertising's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

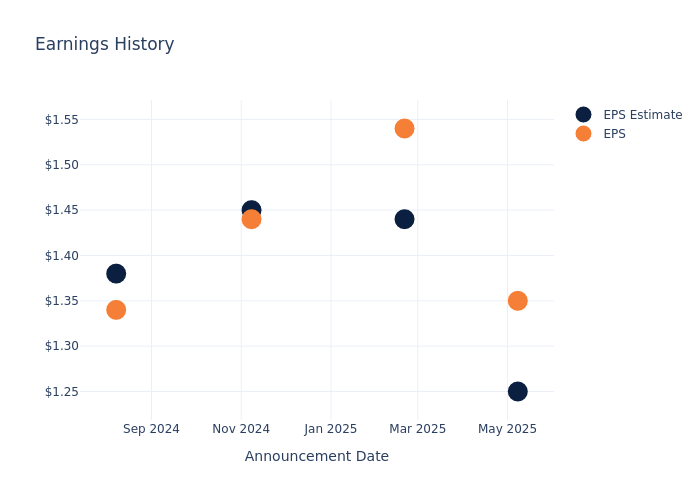

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.10, leading to a 0.37% drop in the share price on the subsequent day.

Here's a look at Lamar Advertising's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.25 | 1.44 | 1.45 | 1.38 |

| EPS Actual | 1.35 | 1.54 | 1.44 | 1.34 |

| Price Change % | -0.0% | -0.0% | -5.0% | -1.0% |

Market Performance of Lamar Advertising's Stock

Shares of Lamar Advertising were trading at $124.56 as of August 06. Over the last 52-week period, shares are up 8.26%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Lamar Advertising

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Lamar Advertising.

Lamar Advertising has received a total of 2 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $135.0, the consensus suggests a potential 8.38% upside.

Peer Ratings Comparison

This comparison focuses on the analyst ratings and average 1-year price targets of Gaming and Leisure Props, EPR Props and Outfront Media, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Gaming and Leisure Props, with an average 1-year price target of $51.61, suggesting a potential 58.57% downside.

- Analysts currently favor an Neutral trajectory for EPR Props, with an average 1-year price target of $58.83, suggesting a potential 52.77% downside.

- Analysts currently favor an Outperform trajectory for Outfront Media, with an average 1-year price target of $19.33, suggesting a potential 84.48% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Gaming and Leisure Props, EPR Props and Outfront Media, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lamar Advertising | Buy | 1.46% | $325.43M | 12.17% |

| Gaming and Leisure Props | Neutral | 3.74% | $380.93M | 3.45% |

| EPR Props | Neutral | 4.52% | $151.19M | 2.99% |

| Outfront Media | Outperform | 17.79% | $169.40M | 3.53% |

Key Takeaway:

Lamar Advertising ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Delving into Lamar Advertising's Background

Lamar Advertising Co is an outdoor advertising companies in the United States and operates as a Real Estate Investment Trust. It rent space for advertising on billboards, buses, shelters, benches, logo plates and in airport terminals and also offer customers a fully integrated service with all aspects of their display requirements from ad copy production to placement and maintenance. It has two operating segments: billboard and Others. Key revenue is generated from Billboard segment.

Unraveling the Financial Story of Lamar Advertising

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Lamar Advertising's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 1.46%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 27.43%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Lamar Advertising's ROE excels beyond industry benchmarks, reaching 12.17%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Lamar Advertising's ROA excels beyond industry benchmarks, reaching 2.11%. This signifies efficient management of assets and strong financial health.

Debt Management: Lamar Advertising's debt-to-equity ratio is below the industry average at 1.11, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Lamar Advertising visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.