Earnings Preview: PAR Technology

PAR Technology (NYSE:PAR) will release its quarterly earnings report on Friday, 2025-08-08. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate PAR Technology to report an earnings per share (EPS) of $-0.06.

The announcement from PAR Technology is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

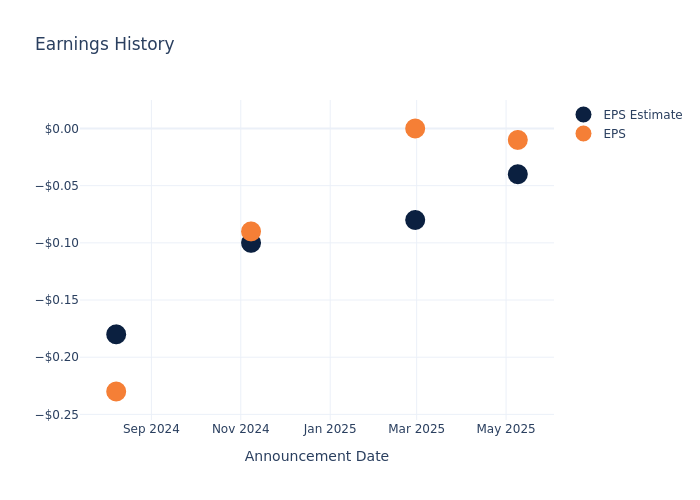

Historical Earnings Performance

Last quarter the company beat EPS by $0.03, which was followed by a 0.0% drop in the share price the next day.

Here's a look at PAR Technology's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | -0.04 | -0.08 | -0.10 | -0.18 |

| EPS Actual | -0.01 | 0 | -0.09 | -0.23 |

| Price Change % | 4.0% | 13.0% | 12.0% | 3.0% |

Performance of PAR Technology Shares

Shares of PAR Technology were trading at $58.35 as of August 06. Over the last 52-week period, shares are up 17.67%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Insights on PAR Technology

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on PAR Technology.

Analysts have provided PAR Technology with 3 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $81.67, suggesting a potential 39.97% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of and Arlo Technologies, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Arlo Technologies, with an average 1-year price target of $24.0, suggesting a potential 58.87% downside.

Snapshot: Peer Analysis

In the peer analysis summary, key metrics for and Arlo Technologies are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| PAR Technology | Buy | 48.22% | $48.34M | -2.83% |

| Arlo Technologies | Buy | -4.13% | $52.73M | -0.82% |

Key Takeaway:

PAR Technology is positioned favorably compared to its peers in terms of Revenue Growth, with a growth rate of 48.22%. However, it lags behind in Gross Profit margin, standing at -2.83%. The Return on Equity for PAR Technology is also negative at -2.83%.

About PAR Technology

PAR Technology Corp is a foodservice technology company providing omnichannel cloud-based software and hardware solutions to the restaurant industry in three restaurant categories - quick service, fast casual, and table service - and the retail industry, including convenience and fuel retailers (C-Stores). The company's product and service offerings include point-of-sale, customer engagement and loyalty, digital ordering and delivery, operational intelligence, payment processing, hardware, and related technologies, solutions, and services. The company generates revenue from subscription service, Sale of Hardware products, and Professional Service.

PAR Technology: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: PAR Technology's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 48.22%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: PAR Technology's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -23.45%, the company may face hurdles in effective cost management.

Return on Equity (ROE): PAR Technology's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -2.83%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -1.76%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: PAR Technology's debt-to-equity ratio stands notably higher than the industry average, reaching 0.47. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for PAR Technology visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.