Evaluating Microsoft Against Peers In Software Industry

In today's fast-paced and highly competitive business world, it is crucial for investors and industry followers to conduct comprehensive company evaluations. In this article, we will delve into an extensive industry comparison, evaluating Microsoft (NASDAQ:MSFT) in relation to its major competitors in the Software industry. By closely examining key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and highlight company's performance in the industry.

Microsoft Background

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Microsoft Corp | 39.05 | 11.67 | 13.98 | 8.27% | $40.71 | $48.15 | 13.27% |

| Oracle Corp | 54.86 | 32.70 | 11.89 | 18.43% | $6.83 | $11.16 | 11.31% |

| ServiceNow Inc | 130.58 | 19.66 | 17.52 | 4.66% | $0.72 | $2.44 | 18.63% |

| Palo Alto Networks Inc | 113.06 | 18.14 | 15.70 | 3.85% | $0.4 | $1.67 | 15.33% |

| Fortinet Inc | 43.13 | 40.87 | 13.20 | 25.08% | $0.56 | $1.25 | 13.77% |

| Gen Digital Inc | 29.63 | 8.34 | 4.84 | 6.43% | $0.53 | $0.81 | 4.77% |

| Monday.Com Ltd | 287.54 | 13.42 | 14.60 | 2.57% | $0.01 | $0.25 | 30.12% |

| CommVault Systems Inc | 99.32 | 22.85 | 7.57 | 10.11% | $0.03 | $0.23 | 23.17% |

| Dolby Laboratories Inc | 29.02 | 2.86 | 5.65 | 3.61% | $0.14 | $0.33 | 1.38% |

| Qualys Inc | 28.85 | 10.29 | 8.42 | 9.75% | $0.06 | $0.13 | 9.67% |

| Teradata Corp | 15.67 | 13.37 | 1.27 | 30.24% | $0.09 | $0.25 | -10.11% |

| Progress Software Corp | 37.64 | 4.66 | 2.51 | 3.85% | $0.08 | $0.19 | 35.57% |

| N-able Inc | 100.62 | 1.96 | 3.23 | -0.93% | $0.01 | $0.09 | 3.91% |

| Rapid7 Inc | 55.59 | 27.77 | 1.69 | 5.98% | $0.02 | $0.15 | 2.51% |

| Average | 78.89 | 16.68 | 8.31 | 9.51% | $0.73 | $1.46 | 12.31% |

By analyzing Microsoft, we can infer the following trends:

-

The Price to Earnings ratio of 39.05 is 0.49x lower than the industry average, indicating potential undervaluation for the stock.

-

The current Price to Book ratio of 11.67, which is 0.7x the industry average, is substantially lower than the industry average, indicating potential undervaluation.

-

The Price to Sales ratio of 13.98, which is 1.68x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

-

With a Return on Equity (ROE) of 8.27% that is 1.24% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

-

The company exhibits higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $40.71 Billion, which is 55.77x above the industry average, implying stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $48.15 Billion, which indicates 32.98x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company's revenue growth of 13.27% exceeds the industry average of 12.31%, indicating strong sales performance and market outperformance.

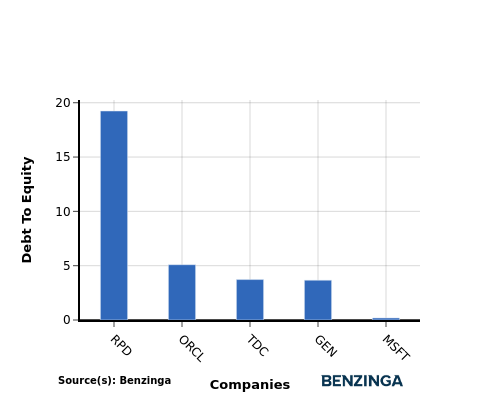

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is an important measure to assess the financial structure and risk profile of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Microsoft and its top 4 peers reveals the following information:

-

Microsoft has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.19.

-

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

Key Takeaways

For Microsoft in the Software industry, the PE and PB ratios suggest the stock is undervalued compared to peers, indicating potential for growth. However, the high PS ratio implies the stock may be overvalued based on revenue. In terms of ROE, EBITDA, gross profit, and revenue growth, Microsoft shows strong performance and growth potential compared to industry peers.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-IANews Markets Trading Ideas