American Airlines Group Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on American Airlines Group.

Looking at options history for American Airlines Group (NASDAQ:AAL) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $754,878 and 4, calls, for a total amount of $196,562.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $15.0 for American Airlines Group over the recent three months.

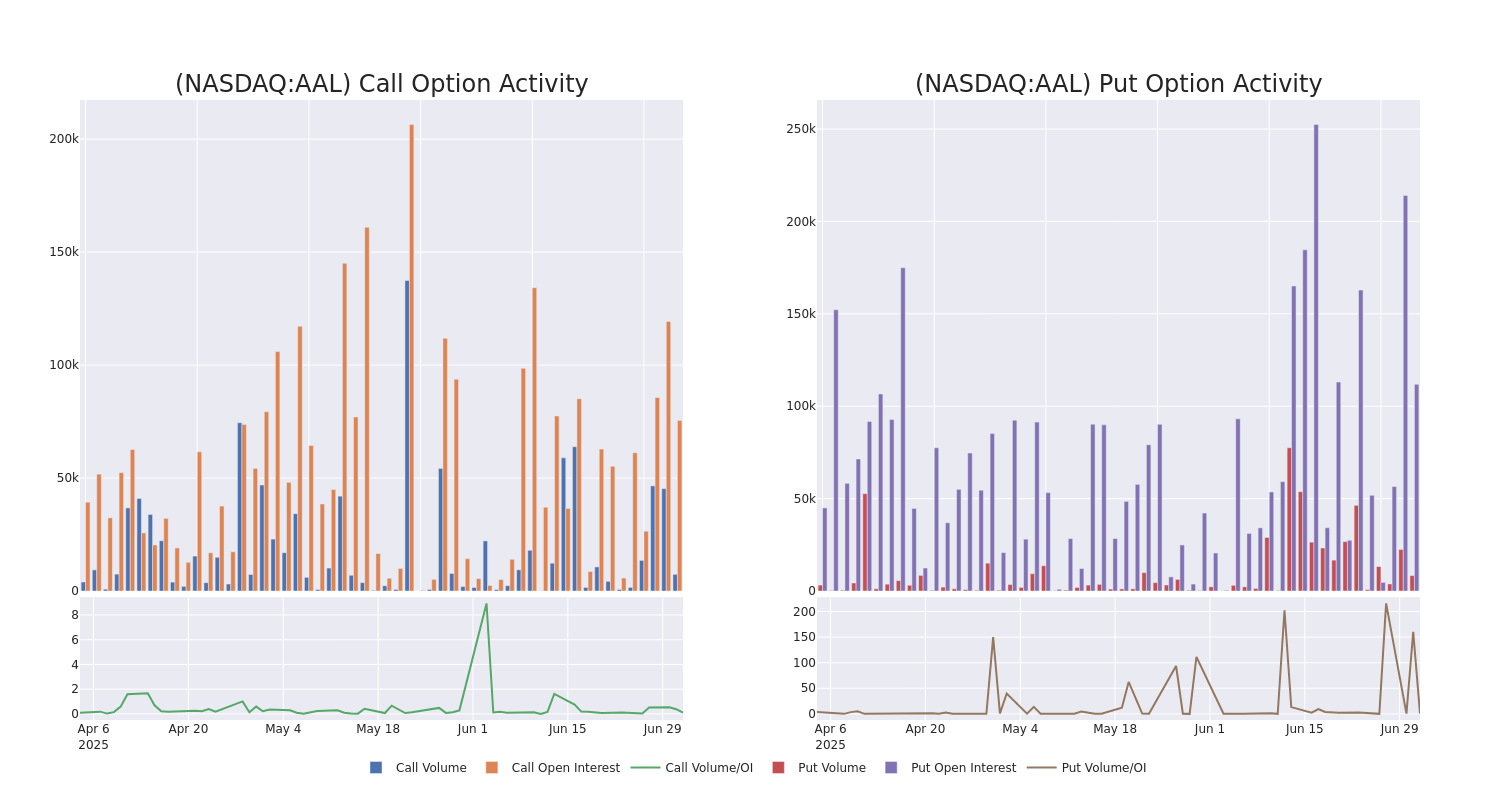

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for American Airlines Group's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of American Airlines Group's whale trades within a strike price range from $10.0 to $15.0 in the last 30 days.

American Airlines Group Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAL | PUT | TRADE | BEARISH | 01/15/27 | $1.56 | $1.47 | $1.56 | $10.00 | $507.0K | 12.3K | 3.2K |

| AAL | PUT | TRADE | BULLISH | 09/18/26 | $4.15 | $4.05 | $4.05 | $15.00 | $107.3K | 1.4K | 266 |

| AAL | CALL | SWEEP | BEARISH | 07/11/25 | $0.17 | $0.16 | $0.16 | $12.50 | $90.5K | 14.5K | 6.5K |

| AAL | PUT | SWEEP | BULLISH | 08/15/25 | $0.56 | $0.54 | $0.54 | $11.00 | $48.1K | 25.3K | 1.7K |

| AAL | PUT | SWEEP | BULLISH | 08/15/25 | $0.56 | $0.53 | $0.53 | $11.00 | $47.0K | 25.3K | 2.5K |

About American Airlines Group

American Airlines is the world's largest airline by aircraft, capacity, and scheduled revenue passenger miles. Its major US hubs are Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, D.C. It generates over 30% of US airline revenue connecting Latin America with destinations in the United States. After completing a major fleet renewal, the company has the youngest fleet of US legacy carriers.

Having examined the options trading patterns of American Airlines Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is American Airlines Group Standing Right Now?

- With a trading volume of 17,626,210, the price of AAL is up by 2.04%, reaching $11.76.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 22 days from now.

Professional Analyst Ratings for American Airlines Group

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $12.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on American Airlines Group with a target price of $12.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for American Airlines Group, Benzinga Pro gives you real-time options trades alerts.