Dow's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Dow.

Looking at options history for Dow (NYSE:DOW) we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 76% of the investors opened trades with bullish expectations and 15% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $634,258 and 3, calls, for a total amount of $150,440.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $25.0 and $42.5 for Dow, spanning the last three months.

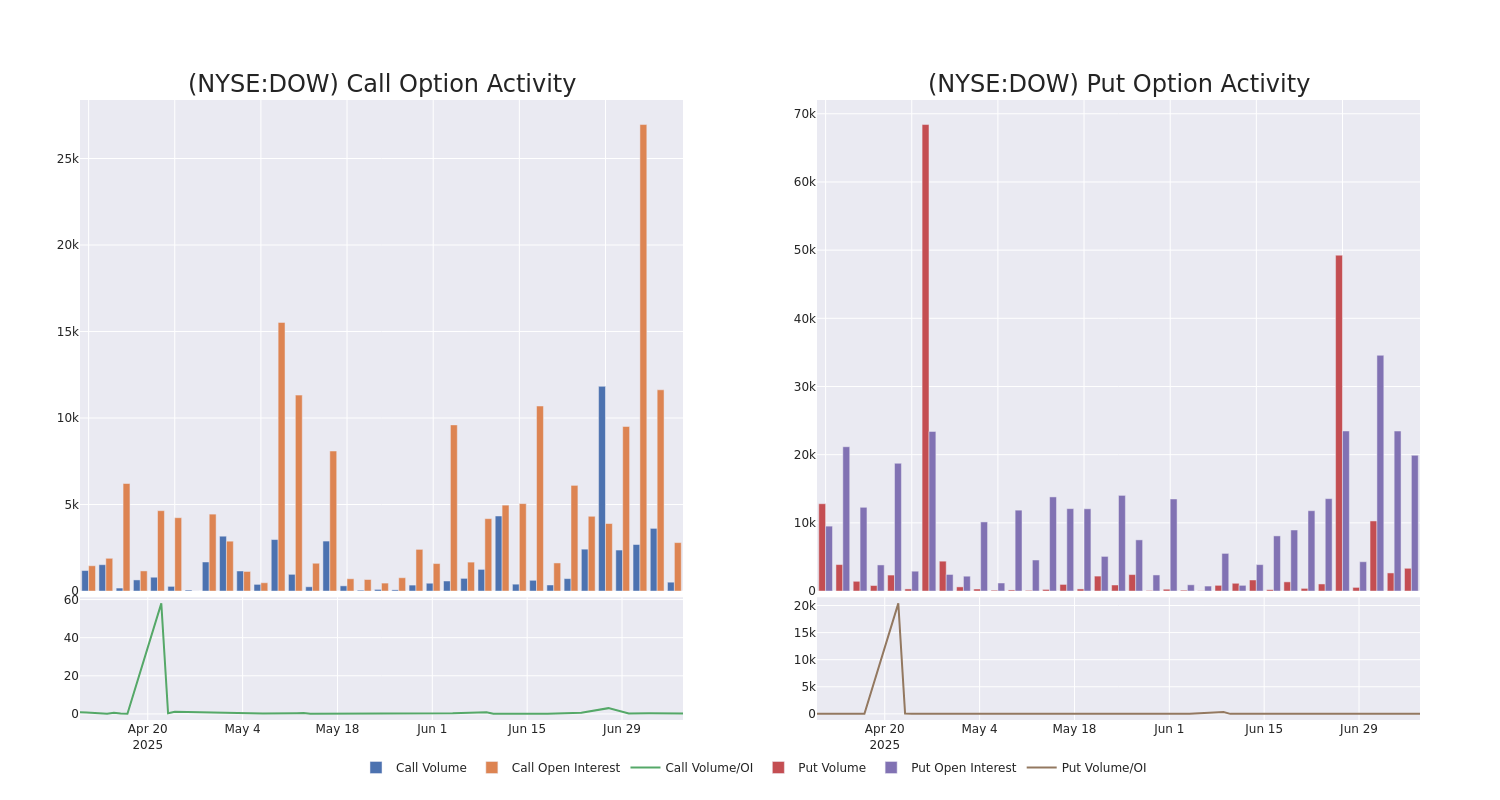

Volume & Open Interest Development

In today's trading context, the average open interest for options of Dow stands at 2270.8, with a total volume reaching 3,850.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dow, situated within the strike price corridor from $25.0 to $42.5, throughout the last 30 days.

Dow Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DOW | PUT | SWEEP | BEARISH | 12/19/25 | $4.1 | $4.05 | $4.1 | $30.00 | $123.4K | 1.9K | 338 |

| DOW | PUT | TRADE | BULLISH | 08/15/25 | $12.05 | $11.75 | $11.8 | $40.00 | $118.0K | 100 | 100 |

| DOW | PUT | TRADE | BULLISH | 12/18/26 | $15.25 | $14.9 | $14.9 | $42.50 | $83.4K | 245 | 0 |

| DOW | PUT | TRADE | BULLISH | 03/20/26 | $3.8 | $3.55 | $3.62 | $27.50 | $82.5K | 4.4K | 264 |

| DOW | CALL | TRADE | BULLISH | 01/15/27 | $4.7 | $4.65 | $4.7 | $30.00 | $57.3K | 1.0K | 136 |

About Dow

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

After a thorough review of the options trading surrounding Dow, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Dow

- Currently trading with a volume of 9,528,363, the DOW's price is up by 6.06%, now at $29.14.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 16 days.

Professional Analyst Ratings for Dow

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Fermium Research has revised its rating downward to Hold, adjusting the price target to $30.

* In a cautious move, an analyst from BMO Capital downgraded its rating to Underperform, setting a price target of $22.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dow, Benzinga Pro gives you real-time options trades alerts.