Check Out What Whales Are Doing With OSCR

Whales with a lot of money to spend have taken a noticeably bearish stance on Oscar Health.

Looking at options history for Oscar Health (NYSE:OSCR) we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $157,684 and 12, calls, for a total amount of $616,470.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $13.0 to $35.0 for Oscar Health during the past quarter.

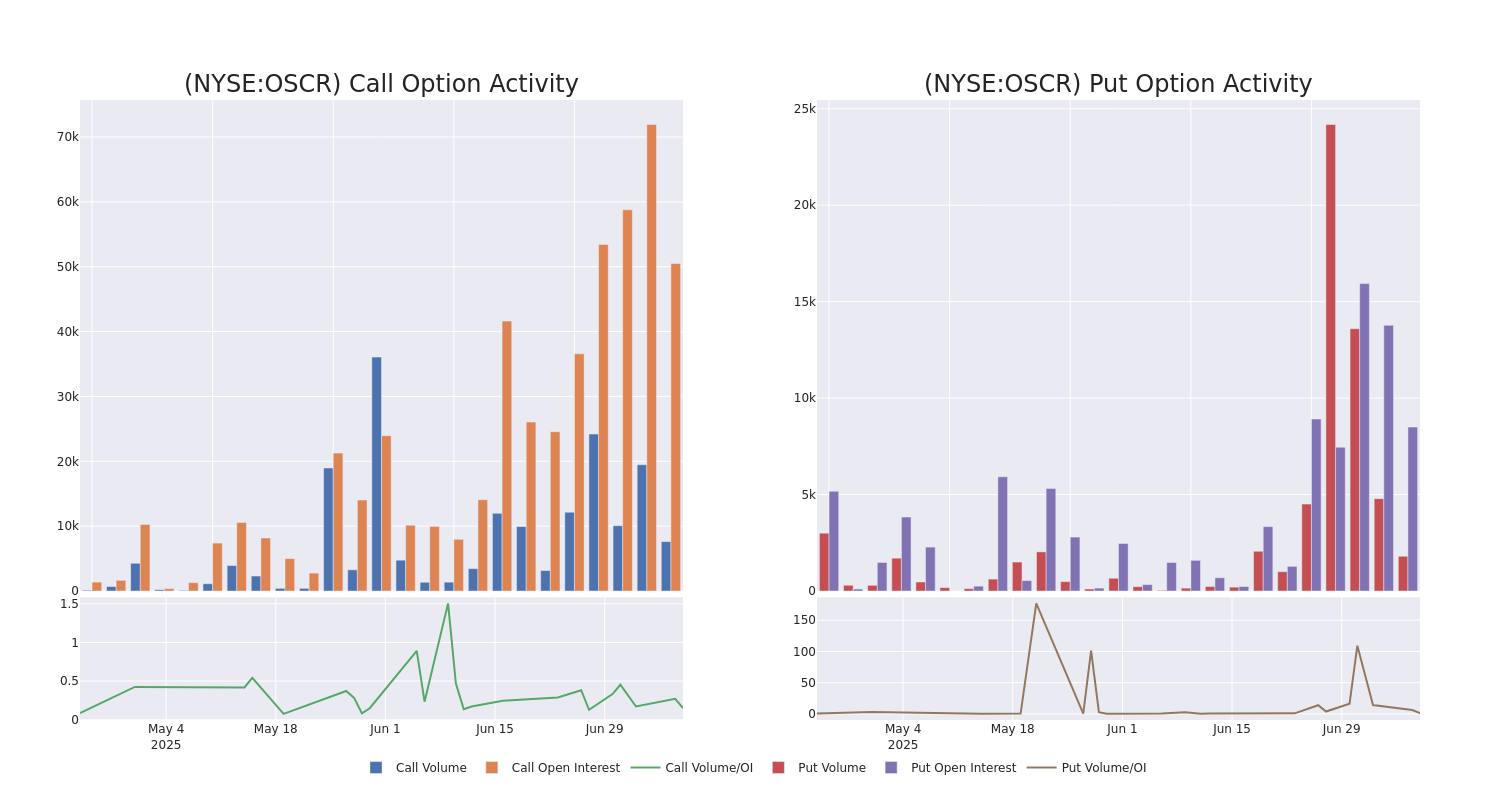

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Oscar Health options trades today is 4537.31 with a total volume of 9,424.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oscar Health's big money trades within a strike price range of $13.0 to $35.0 over the last 30 days.

Oscar Health Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OSCR | CALL | TRADE | BEARISH | 01/15/27 | $6.7 | $6.6 | $6.6 | $20.00 | $132.0K | 5.6K | 416 |

| OSCR | CALL | TRADE | BULLISH | 01/15/27 | $6.6 | $6.2 | $6.5 | $20.00 | $112.4K | 5.6K | 27 |

| OSCR | CALL | SWEEP | BULLISH | 01/15/27 | $3.7 | $3.6 | $3.7 | $35.00 | $55.8K | 5.5K | 187 |

| OSCR | PUT | SWEEP | BULLISH | 08/08/25 | $1.25 | $1.1 | $1.15 | $15.00 | $51.7K | 661 | 504 |

| OSCR | CALL | SWEEP | BEARISH | 01/16/26 | $5.0 | $4.8 | $4.8 | $16.00 | $48.0K | 935 | 117 |

About Oscar Health

Oscar Health Inc is a health insurance company. The company provides various insurance plans for individuals, families, and employees. Also, the company provides virtual care, doctor support, scheduling appointments, and other related services. The company provides plans in the Medicare Advantage program to adults who are age 65 and older and eligible for traditional Medicare but who instead select coverage through a private market plan.

In light of the recent options history for Oscar Health, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Oscar Health's Current Market Status

- With a volume of 8,610,664, the price of OSCR is up 1.09% at $16.73.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 28 days.

Expert Opinions on Oscar Health

In the last month, 1 experts released ratings on this stock with an average target price of $17.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Barclays lowers its rating to Underweight with a new price target of $17.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oscar Health with Benzinga Pro for real-time alerts.