Behind the Scenes of Snap's Latest Options Trends

Deep-pocketed investors have adopted a bearish approach towards Snap (NYSE:SNAP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SNAP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Snap. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $548,256, and 10 are calls, amounting to $446,409.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.0 to $25.0 for Snap during the past quarter.

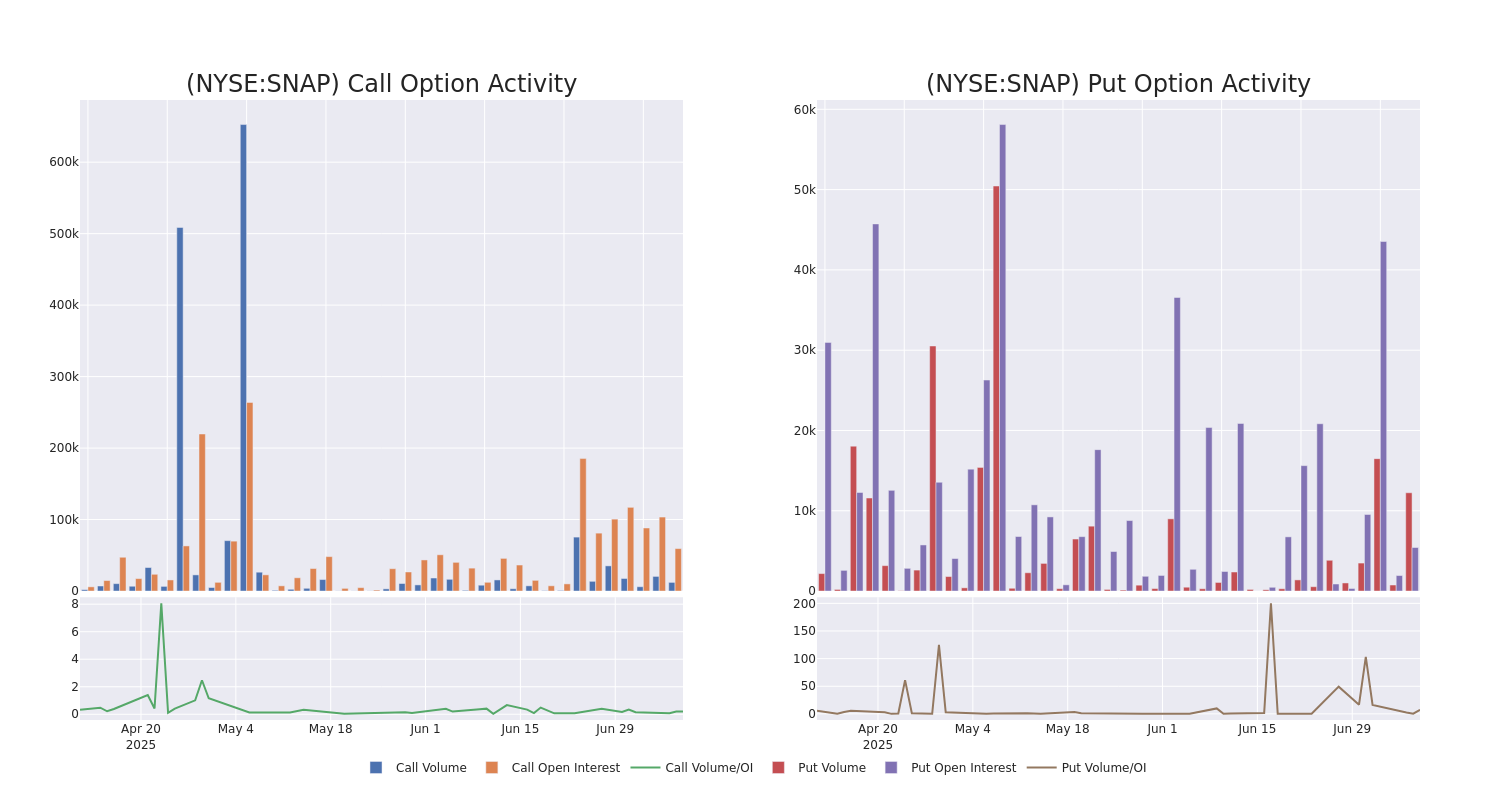

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $7.0 to $25.0, over the past month.

Snap Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | PUT | TRADE | BULLISH | 01/16/26 | $1.52 | $1.47 | $1.49 | $9.00 | $298.0K | 2.4K | 2.3K |

| SNAP | CALL | TRADE | NEUTRAL | 01/15/27 | $1.17 | $1.11 | $1.14 | $17.00 | $113.8K | 1.1K | 1.0K |

| SNAP | PUT | SWEEP | BEARISH | 07/18/25 | $0.74 | $0.74 | $0.74 | $10.00 | $60.9K | 1.6K | 2.8K |

| SNAP | PUT | SWEEP | BULLISH | 07/18/25 | $0.77 | $0.75 | $0.75 | $10.00 | $55.3K | 1.6K | 2.0K |

| SNAP | PUT | SWEEP | BULLISH | 07/18/25 | $0.77 | $0.75 | $0.75 | $10.00 | $51.7K | 1.6K | 1.3K |

About Snap

Snap is a technology company best known for its marquis social media application Snapchat, a visual messaging application that has amassed hundreds of millions of users. The app was initially only used to communicate with family and friends through photographs and short videos (known as "Snaps"). Users can now enjoy augmented reality, or AR, lenses, content from famous creators and celebrities, updates about local events, and more. Although the app offers a paid subscription option with premium features, advertising sales produce most of the app's revenue. The firm also sells wearable devices called AR Spectacles, which can capture photos and videos overlayed with AR lenses, but these make up a small portion of Snap's overall sales.

Following our analysis of the options activities associated with Snap, we pivot to a closer look at the company's own performance.

Current Position of Snap

- Trading volume stands at 35,411,086, with SNAP's price down by -1.61%, positioned at $9.17.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 22 days.

Expert Opinions on Snap

In the last month, 1 experts released ratings on this stock with an average target price of $11.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Snap, targeting a price of $11.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Snap, Benzinga Pro gives you real-time options trades alerts.