Market Whales and Their Recent Bets on FCX Options

Deep-pocketed investors have adopted a bullish approach towards Freeport-McMoRan (NYSE:FCX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in FCX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 35 extraordinary options activities for Freeport-McMoRan. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 40% bearish. Among these notable options, 8 are puts, totaling $1,521,658, and 27 are calls, amounting to $2,921,284.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $60.0 for Freeport-McMoRan over the recent three months.

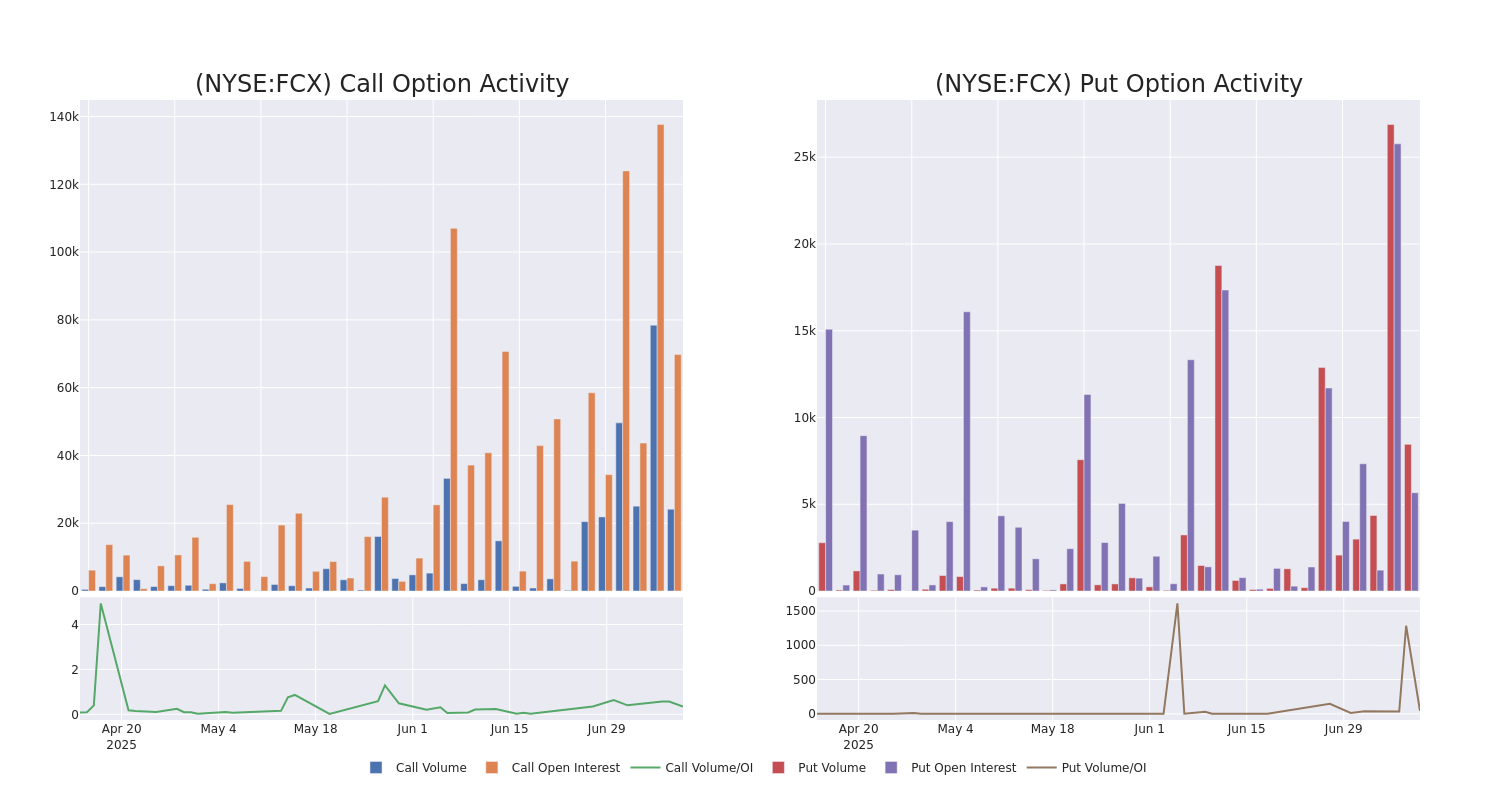

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Freeport-McMoRan's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Freeport-McMoRan's whale activity within a strike price range from $40.0 to $60.0 in the last 30 days.

Freeport-McMoRan 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | PUT | TRADE | BEARISH | 01/15/27 | $5.7 | $3.65 | $5.2 | $42.00 | $468.0K | 369 | 900 |

| FCX | PUT | TRADE | BEARISH | 09/19/25 | $2.1 | $2.05 | $2.09 | $45.00 | $386.6K | 3.6K | 2.0K |

| FCX | CALL | SWEEP | BEARISH | 08/15/25 | $7.65 | $7.5 | $7.5 | $40.00 | $375.0K | 7.3K | 3.1K |

| FCX | CALL | SWEEP | BULLISH | 08/15/25 | $7.7 | $7.45 | $7.5 | $40.00 | $372.7K | 7.3K | 1.7K |

| FCX | PUT | SWEEP | NEUTRAL | 07/11/25 | $2.01 | $1.61 | $1.78 | $48.00 | $356.0K | 57 | 2.0K |

About Freeport-McMoRan

Freeport-McMoRan owns stakes in 10 copper mines, led by its 49% ownership of the Grasberg copper and gold operations in Indonesia, 55% of the Cerro Verde mine in Peru, and 72% of Morenci in Arizona. It sold around 1.2 million metric tons of copper (its share) in 2024, making it the one of the world's largest copper miners by volume. It also sold about 900,000 ounces of gold, mostly from Grasberg, and 70 million pounds of molybdenum. It had about 25 years of copper reserves at the end of December 2024. We expect it to sell similar amounts of copper midcycle in 2029, though we expect gold volumes to decline to about 700,000 ounces then due to falling production at Grasberg.

Present Market Standing of Freeport-McMoRan

- Currently trading with a volume of 8,943,227, the FCX's price is up by 2.61%, now at $46.78.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 13 days.

What The Experts Say On Freeport-McMoRan

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $52.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Scotiabank has decided to maintain their Sector Outperform rating on Freeport-McMoRan, which currently sits at a price target of $52.

* Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Freeport-McMoRan, targeting a price of $48.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Freeport-McMoRan, which currently sits at a price target of $56.

* In a positive move, an analyst from Scotiabank has upgraded their rating to Sector Outperform and adjusted the price target to $48.

* An analyst from Stifel has revised its rating downward to Buy, adjusting the price target to $56.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Freeport-McMoRan, Benzinga Pro gives you real-time options trades alerts.