This Is What Whales Are Betting On Ulta Beauty

Financial giants have made a conspicuous bearish move on Ulta Beauty. Our analysis of options history for Ulta Beauty (NASDAQ:ULTA) revealed 10 unusual trades.

Delving into the details, we found 30% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $204,113, and 5 were calls, valued at $289,158.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $370.0 to $490.0 for Ulta Beauty over the last 3 months.

Insights into Volume & Open Interest

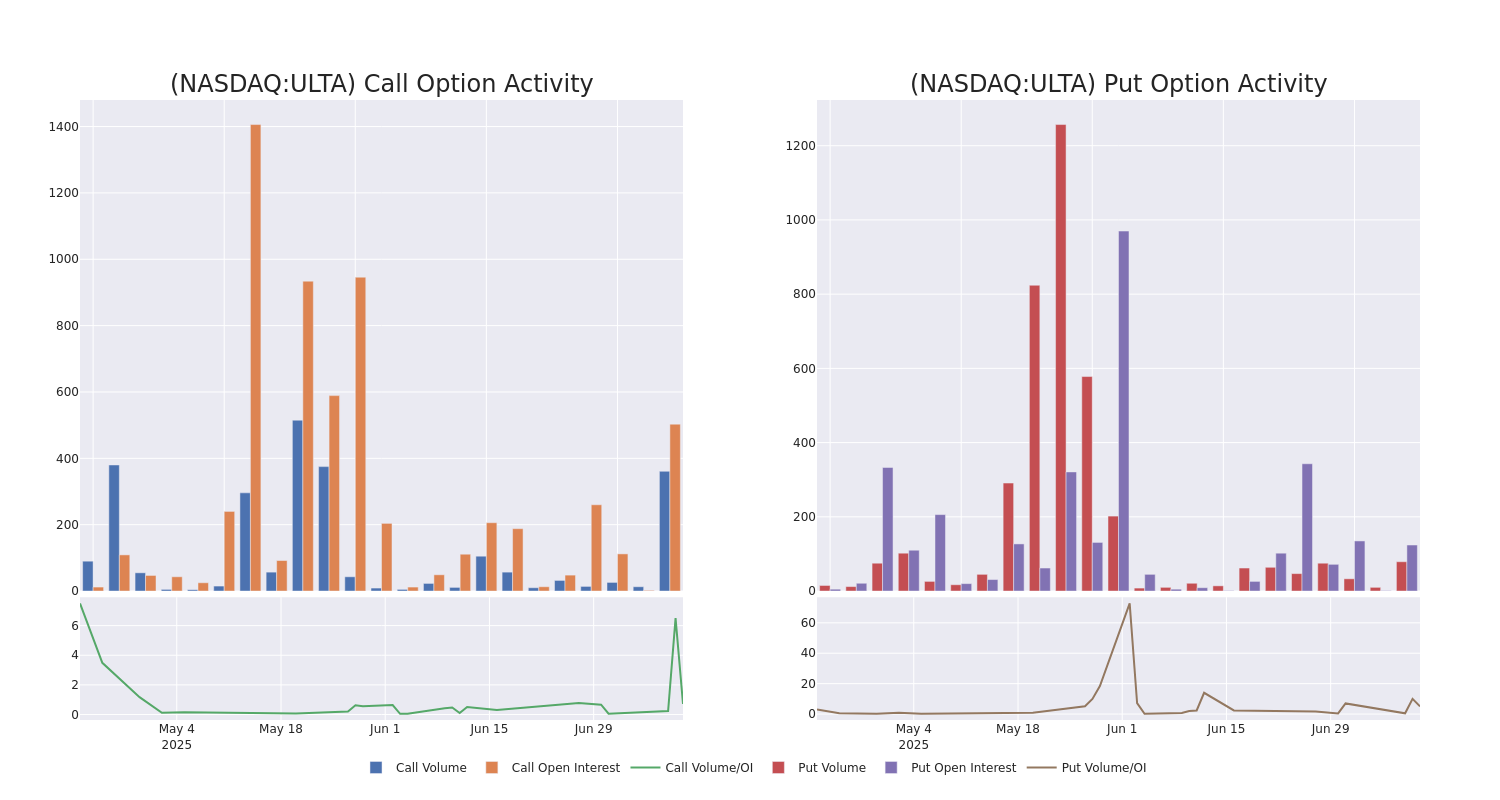

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Ulta Beauty's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Ulta Beauty's whale trades within a strike price range from $370.0 to $490.0 in the last 30 days.

Ulta Beauty Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ULTA | CALL | TRADE | BULLISH | 07/18/25 | $7.2 | $6.7 | $7.2 | $475.00 | $146.8K | 162 | 219 |

| ULTA | PUT | TRADE | BEARISH | 12/19/25 | $42.4 | $41.8 | $42.4 | $490.00 | $63.6K | 57 | 16 |

| ULTA | PUT | SWEEP | BULLISH | 01/15/27 | $42.6 | $40.3 | $40.3 | $420.00 | $56.5K | 4 | 14 |

| ULTA | CALL | TRADE | BULLISH | 07/18/25 | $4.3 | $3.9 | $4.22 | $480.00 | $46.8K | 130 | 137 |

| ULTA | CALL | TRADE | BEARISH | 09/19/25 | $114.2 | $111.0 | $111.0 | $370.00 | $33.3K | 122 | 3 |

About Ulta Beauty

With more than 1,400 freestanding stores and 600 Target shop-in-shops, Ulta Beauty is the largest specialized beauty retailer in the US. The firm offers cosmetics (39% of 2024 sales), fragrances (13%), skin care (23%), and hair care products (19%). It also offers salon services, including hair, makeup, skin, and brow, that account for about 4% of its revenue and drive traffic. In addition, it collects royalties through its Target partnership and credit card revenue. Most standalone Ulta stores are approximately 10,000 square feet and are in suburban strip centers. The firm will soon open franchised stores in Mexico and has formed a joint venture to expand into the Middle East. Ulta was founded in 1990 and is based in Bolingbrook, Illinois.

After a thorough review of the options trading surrounding Ulta Beauty, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Ulta Beauty

- With a volume of 309,551, the price of ULTA is up 0.11% at $476.68.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 48 days.

What The Experts Say On Ulta Beauty

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $525.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Telsey Advisory Group has decided to maintain their Outperform rating on Ulta Beauty, which currently sits at a price target of $520.

* Maintaining their stance, an analyst from Loop Capital continues to hold a Buy rating for Ulta Beauty, targeting a price of $510.

* An analyst from Telsey Advisory Group persists with their Outperform rating on Ulta Beauty, maintaining a target price of $520.

* Consistent in their evaluation, an analyst from DA Davidson keeps a Buy rating on Ulta Beauty with a target price of $550.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Ulta Beauty, Benzinga Pro gives you real-time options trades alerts.