Behind the Scenes of Roblox's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Roblox (NYSE:RBLX).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with RBLX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 10 uncommon options trades for Roblox.

This isn't normal.

The overall sentiment of these big-money traders is split between 70% bullish and 20%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $309,509, and 5 are calls, for a total amount of $386,992.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $145.0 for Roblox over the recent three months.

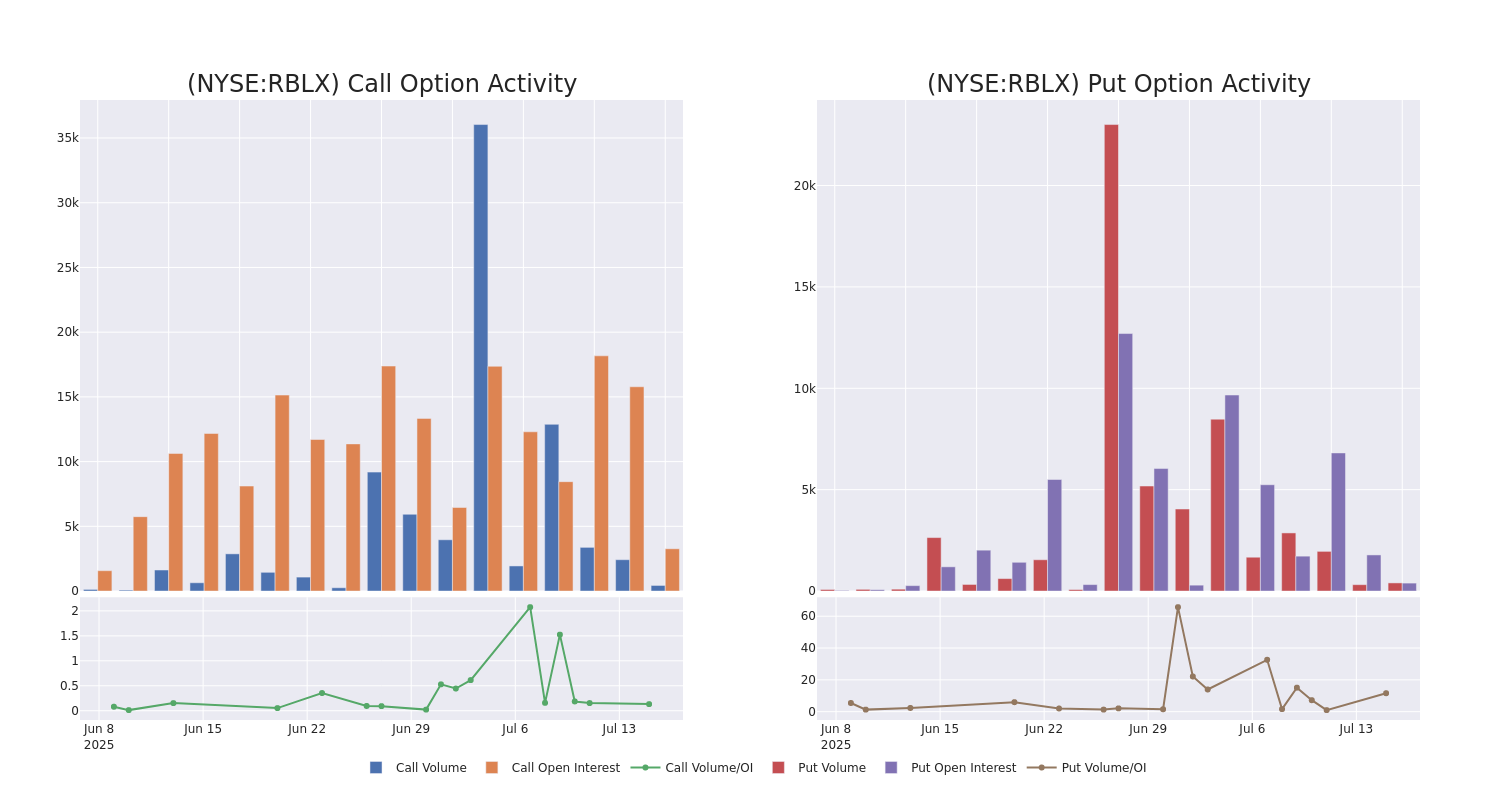

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Roblox options trades today is 457.12 with a total volume of 833.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Roblox's big money trades within a strike price range of $100.0 to $145.0 over the last 30 days.

Roblox Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | CALL | SWEEP | BEARISH | 01/16/26 | $19.0 | $18.5 | $18.45 | $110.00 | $129.1K | 434 | 71 |

| RBLX | CALL | SWEEP | BEARISH | 01/16/26 | $15.25 | $15.15 | $15.15 | $120.00 | $103.0K | 1.1K | 70 |

| RBLX | PUT | SWEEP | BULLISH | 09/19/25 | $18.3 | $17.95 | $18.05 | $125.00 | $86.6K | 26 | 65 |

| RBLX | PUT | TRADE | BULLISH | 01/16/26 | $15.2 | $15.15 | $15.15 | $110.00 | $75.7K | 153 | 50 |

| RBLX | PUT | SWEEP | BULLISH | 09/19/25 | $18.55 | $18.35 | $18.35 | $125.00 | $62.3K | 26 | 130 |

About Roblox

Roblox operates a free-to-play online video game platform with about 85 million daily active users. This platform has spawned a virtual universe and a Roblox economy based on the Robux currency. The platform houses millions of games from a wide range of creators spanning from young gamers themselves to professional development studios. Roblox offers creators the tools, publishing abilities, and platform for their games, enabling anyone to create a game. Creators earn money when gamers make optional in-game purchases within their games and by offering space for real-world advertising, and Roblox earns revenue primarily by taking a cut of these earnings.

After a thorough review of the options trading surrounding Roblox, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Roblox Standing Right Now?

- Currently trading with a volume of 2,007,566, the RBLX's price is up by 0.22%, now at $112.08.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 16 days.

Professional Analyst Ratings for Roblox

5 market experts have recently issued ratings for this stock, with a consensus target price of $121.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Roblox with a target price of $124.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Roblox, targeting a price of $116.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Roblox with a target price of $120.

* An analyst from Citigroup has decided to maintain their Buy rating on Roblox, which currently sits at a price target of $123.

* An analyst from Oppenheimer has revised its rating downward to Outperform, adjusting the price target to $125.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Roblox with Benzinga Pro for real-time alerts.